Finance Minister Yassine Jaber, in coordination with Economy and Trade Minister Amer Bsat, is preparing to present a draft law titled the “Financial Regularization and Deposit Recovery Act” to the Cabinet for approval, before forwarding it to Parliament.

The Government’s Deposit Recovery Plan

Three parties contributed to shaping this plan: the central bank (handling the technical side), the two ministers, and the governor of the Banque du Liban (BDL), who made the overarching decisions. It remains unclear whether the International Monetary Fund (IMF) had a role in drafting the proposal.

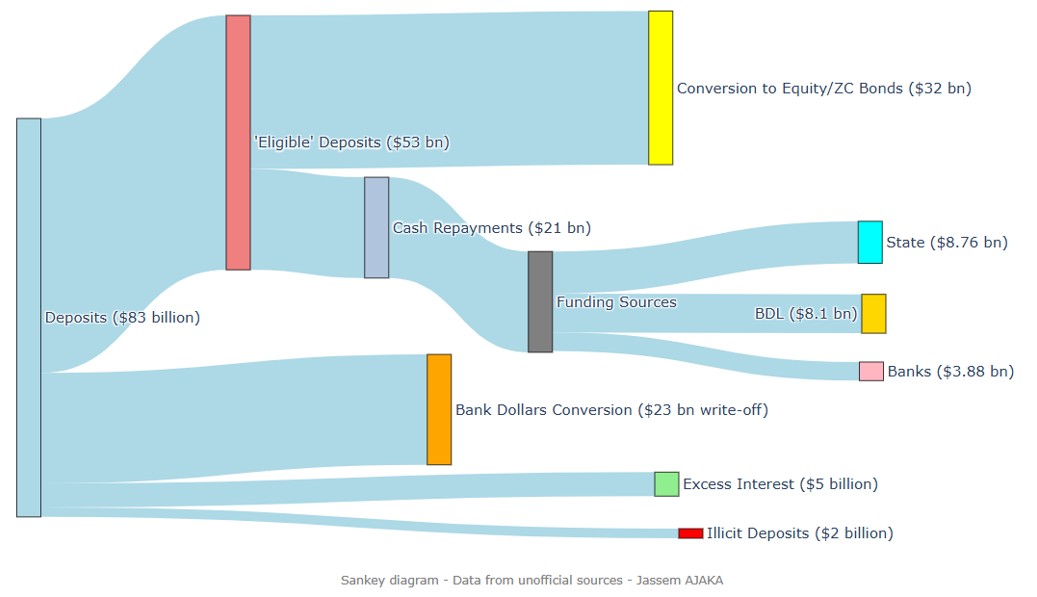

The plan addresses deposits valued at $83 billion (see Chart 1). Of that amount, $53 billion were designated as “eligible deposits.” Of these, $21 billion would be repaid in cash through BDL circulars over five years. The remaining $32 billion would be converted—at the depositor’s discretion—into either bank shares or BDL-issued bonds (long-term, zero-interest bonds maturing in 15 years).

Funding the $21 billion cash repayment would require contributions of $8.76 billion from the government, $8.1 billion from BDL, and $3.88 billion from the banks. According to leaks, deposits under $100,000 would be prioritized for repayment. For deposits exceeding $100,000, the first $100,000 would be repaid, while the surplus would be converted into bank shares or BDL bonds.

The plan also deems $30 billion in deposits “non-eligible,” to be written off as follows: $23 billion in post-crisis conversions from Lebanese pounds to U.S. dollars (labeled “bank dollars”); $5 billion in excess interest rates deemed unjustified; and $2 billion in deposits classified as violating Law 44/2015, which grants Lebanon’s Special Investigation Commission authority to freeze funds pending judicial rulings.

Figure 1: Financial Sector Deposit Restructuring Plan (Data from unofficial sources).

Figure 1: Financial Sector Deposit Restructuring Plan (Data from unofficial sources).

Legitimate Questions

Public opinion is split between supporters and critics of the plan, with many questions still unanswered:

- What guarantees exist that bank shares or BDL bonds will eventually restore deposit values, even partially? Early estimates suggest BDL bonds would trade at only 20% of their nominal value, implying an 80% haircut on the $32 billion set for conversion. Bank shares could fare no better if the political and security crises persist.

- Why dismiss “bank dollars”? Many deposits were converted from Lebanese pounds into dollars with approval from monetary authorities. BDL itself allowed loans denominated in dollars to be repaid in pounds at the official 1,500 rate, and circulars 158 and 166 recognized “bank dollars” as legitimate. Why does the plan now disqualify them? Will depositors who benefited from earlier circulars be asked to return those funds?

- Where is the government’s accountability for distributing dollars to money exchangers in April 2020 at 1,500 pounds per dollar (on orders from then-PM Hassan Diab)? Or for subsidizing imports that enriched political elites? Were these not depositors’ funds? Has any investigation taken place?

- What about real estate purchases made in 2020 with checks valued below face value and cash of unknown origin, totaling over $10 billion? Have these been investigated?

- What about the $6 billion transferred abroad in the first two weeks of the October 17, 2019 protests? Were these funds legitimate under Law 44/2015?

- Why no probe into the cash smuggled to Syria from August 2019 until acting governor Wassim Mansouri took office in August 2023?

- Where will the government find $8.76 billion to fund its share of repayments when it is still negotiating for a $3 billion IMF loan?

The list of questions goes on.

IMF Conditions and Political Will

Reports indicate a dispute over a $16.5 billion debt the Lebanese state allegedly owes BDL as of April 2023, stemming from exchange-rate differentials accumulated in a special account created in the late 1990s. Refusing to recognize this debt could derail BDL’s balance-sheet recovery plan. Yet the IMF is reluctant to load the state with more debt beyond Eurobond liabilities, as it seeks to preserve Lebanon’s minimal solvency needed to repay its loans.

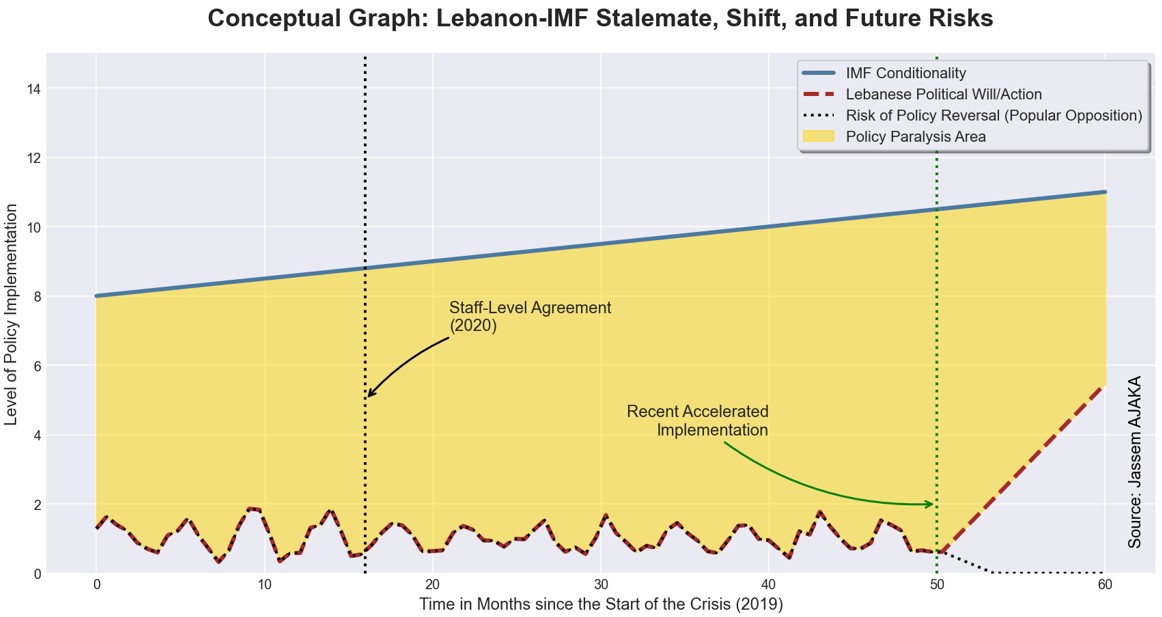

Figure 2: Lebanon-IMF Stalemate, Shift, and Future Risks (Source: Our Estimations)

Figure 2: Lebanon-IMF Stalemate, Shift, and Future Risks (Source: Our Estimations)

The government has accelerated efforts to meet IMF demands. Even if Parliament approves the draft law, the Cabinet will still face a long list of requirements before Lebanon can qualify for a program (see Chart 2). Among them:

- A credible, comprehensive strategy for bank restructuring and loss recognition;

- Passage of a bank resolution law to provide a legal framework for restructuring;

- Reforms to Lebanon’s banking secrecy laws;

- Unification of multiple exchange rates;

- A medium-term fiscal strategy to restore debt sustainability.

While the political class appears determined to satisfy IMF conditions, one unpredictable factor remains: public opinion. With parliamentary elections looming—if they occur—the Lebanese people may yet upend the entire process by “flipping the table” on a system they no longer trust.

Please post your comments on:

[email protected]

Politics

Politics