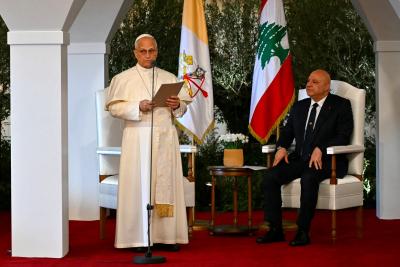

Lebanon welcomed French presidential envoy Jean-Yves Le Drian this week, tasked with preparing two international conferences: one to rally support for the Lebanese Army, the other to secure international political and financial backing for Lebanon’s economic recovery and reconstruction.

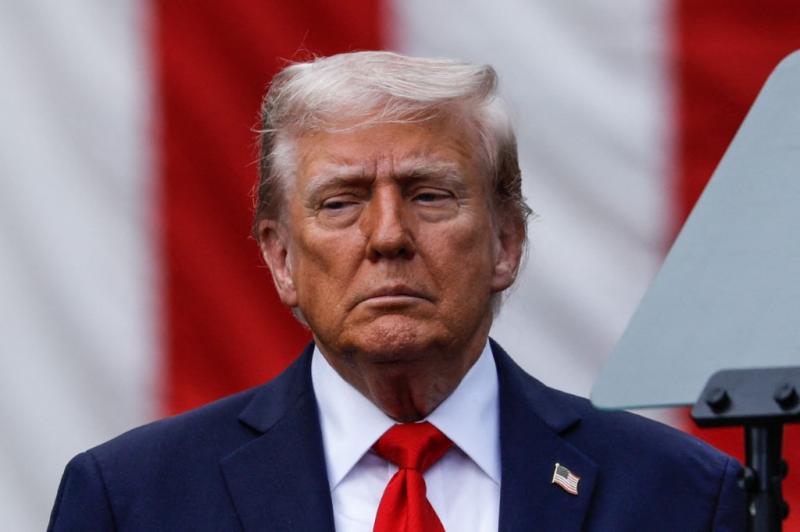

But Le Drian’s arrival was overshadowed by upheaval in Paris. The French government of Prime Minister François Bayrou collapsed after losing a confidence vote in the National Assembly, triggered by a 2026 austerity budget designed to cut €44 billion. It is the fourth government to fall during Emmanuel Macron’s second presidential term—and the third since he called snap elections after the far right’s victory in European polls.

Macron wasted no time appointing Defense Minister Sébastien Lecornu as prime minister, charging him with forming a coalition government capable of passing a new austerity plan. But Lecornu inherits two challenges that defeated his predecessors: forging a parliamentary coalition strong enough to withstand a fragmented National Assembly, and persuading the French public to accept austerity. Without reform, France risks sliding into a financial and political crisis that will be difficult to repair.

A Divided Parliament, a Weak Government

Bayrou’s government fell after lawmakers rejected the budget aimed at trimming €44 billion from public debt, which now stands at 114% of GDP. The vote exposed the depth of France’s political divisions. Marine Le Pen’s far-right National Rally demanded new legislative elections. Jean-Luc Mélenchon’s far-left France Unbowed called for Macron’s resignation. The Socialist Party insisted it had the right to lead government after topping the last parliamentary elections. And the conservative Republicans refused to join any left-led coalition.

Economic Pressures: Mounting Debt, Stagnant Growth

- France’s debt crisis is unprecedented and threatens its economic stability:

- By mid-2025, total public and private debt reached €7.65 trillion ($8.87 trillion), more than double GDP.

- Government debt alone hit €3.346 trillion (115% of GDP), up from €1.59 trillion in 2010 (82.4% of GDP), doubling in 15 years.

- Nearly €900 billion was added to public debt between 2020 and mid-2025.

- Servicing the debt will cost €62 billion in 2025 and is projected to reach €100 billion by 2029.

Growth is faltering. GDP is forecast to expand by just 0.6% in 2025, down from 0.8% in 2024—among the weakest in Europe. The private sector has been contracting for 11 straight months, with the composite PMI at 48.6 in July (anything below 50 signals contraction). Manufacturing’s share fell from 18.5% in 2023 to 17.5% in 2024, highlighting industrial decline under heavy taxes and sluggish investment.

Social Unrest

Social tensions are rising. A new movement under the slogan “Shut Everything Down,” backed by some unions and the far left, began actions this week. The Interior Ministry deployed 80,000 security personnel to contain hundreds of planned demonstrations.

Public frustration is high: 77% of French citizens disapprove of Macron’s performance, his popularity hitting its lowest since 2017. In 2023 alone, France witnessed more than 12,000 protests—up 18% from 2022—averaging 66 per month, one of the highest rates in Europe.

A Threat to EU Stability

Macron has often argued that France’s stability is crucial for Europe. When France shakes, so does the EU. As the eurozone’s second-largest economy, French turbulence threatens the euro’s stability and investor confidence.

The yield on French 10-year bonds has risen to match that of Italy’s—a first in 15 years. For years, Italy was seen as Europe’s weakest link in debt management.

France’s political and economic weakness also strains its influence in the EU. Disputes over nuclear policy, reliance on the United States, and the French welfare model are widening Paris’s isolation. The once-powerful Franco-German axis—the EU’s backbone—is faltering: Germany expects growth of just 1% in 2026, while France needs austerity to rein in debt. Differences over budgets and trade policy remain obstacles.

Domestic Turmoil Weakening Diplomacy

France’s internal crisis could force the new government to scale back on foreign policy, including its commitments to Ukraine and Lebanon. With debt servicing costs soaring, Paris may find it harder to provide financial aid abroad.

Still, France is likely to maintain its traditional diplomatic role in Europe and the Middle East, especially after retreating from much of Africa. Yet dwindling resources will weaken the impact of French diplomacy.

An Existential Test for the French Model

After Gabriel Attal’s failed plans, Michel Barnier’s shortcomings, and Bayrou’s collapse, Sébastien Lecornu, at just 39, faces a near-impossible task: reconciling France’s contradictions, reviving its economy, and preserving its social model.

Nothing short of fresh elections to produce a clear majority may stabilize France politically and economically. Until then, the country risks losing stature—both at home and abroad.

Please post your comments on:

[email protected]

Politics

Politics