On October 17, 2019, the streets of Lebanon erupted with spontaneous popular protests rejecting a proposed tax on WhatsApp calls. These protests soon escalated to a “revolution” against corruption and the mismanagement of public funds. The following months were catastrophic for all the people living in the county as the financial crisis devastated the purchasing power—which fell by more than 82 fold—and depositors lost access to their money held in banks.

In April 2020, at the government’s request, the Central Bank launched the largest injection of U.S. dollars into the market to subsidize essential goods, fuel, and medicines, aiming to make them affordable to the general public. On the surface, this appeared to be a humanitarian effort to protect the people. However, it turned into a systematic plundering of the Central Bank’s reserves, under a legal framework sponsored by the government and labeled a social protection program.

Mechanism With no Control

The subsidy mechanism stipulated that the Central Bank provide dollars from its reserves to support the import of essential goods. Importers would apply for dollars at a fixed exchange rate of 1,500 Lebanese pounds per dollar (later at the official Sayrafa platform rate). After the Ministry of Economy’s approval, the Central Bank would transfer dollars to suppliers, who in turn would ship the goods to Lebanon.

However, the process did not unfold as planned. Most submitted invoices were fake or inflated, so the quantity of subsidized goods available in Lebanon was significantly less than what was purchased at the subsidized rate. Strangely, many subsidized goods stamped with the “Supported by the Ministry of Economy and Trade” seal were found being sold abroad—in countries such as Syria, Cyprus, Turkey, Jordan, the Democratic Republic of Congo, several Gulf states, and even Australia, where coffee stamped with the subsidy seal was sold!

Huge Profits

These subsidized goods were sold in Lebanon at black market dollar rates, while importers bought dollars at the official subsidized rate of 1,500 LBP/USD or via the Sayrafa platform. This currency exploitation occurred without any oversight from the government or the Central Bank.

A televised report exposed how subsidized goods were smuggled into Syria and traders were confronted —yet no prosecutions or accountability followed. Importers enjoyed protection from influential figures who backed their interests and ensured a steady supply of subsidized goods for their operations, including electoral campains.

The importers’ real profits reached billions. With no evidence disproving this, all expenditures from the Central Bank reserves appear to have been squandered through channels benefiting corrupt parties.

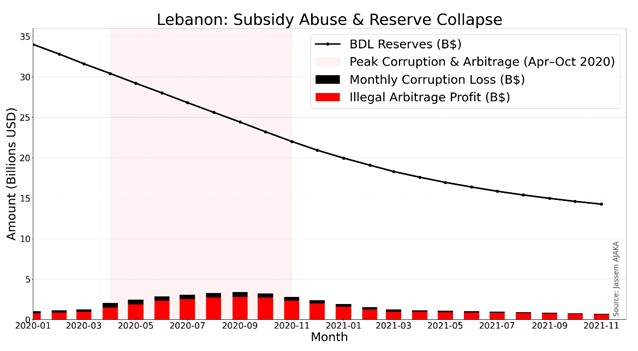

Based on data from the Central Bank’s official website and customs databases, assuming subsidy distribution across fuel, medicines, and food (at varying ratios), the scale of illicit gains from direct corruption (Monthly Corruption Loss) and currency arbitrage (Illegal Arbitrage Profit) reached billions. The peak occurred between April and November 2020, with support continuing until the fourth quarter of 2021.

Of course, these figures—illustrated approximately in the attached chart (Figure 1)—are estimates of a reality that can only be fully uncovered through a detailed audit of the Central Bank’s accounts during the subsidy period, to precisely determine its size and take appropriate measures.

These funds originate from commercial bank deposits held at the Central Bank and therefore belong to depositors. Hence, every dollar spent on subsidies must be audited, and any unjustly acquired funds returned to their rightful owners.

Figure 1: Approximate Simulation of Corruption Scale Accompanying the 2020 Subsidy Mechanism (Source: Our Calculations)

Figure 1: Approximate Simulation of Corruption Scale Accompanying the 2020 Subsidy Mechanism (Source: Our Calculations)

Responsibilities as mapped in the Subsidy File

While awaiting judicial decisions, citizens have the right to know the following:

- Subsidies were implemented without oversight by the Audit Bureau. The Ministry of Economy and Trade defined a basket of 300 subsidized goods without clear criteria, approved import requests, and the Central Bank executed them. No one verified if the invoiced goods were all sold in Lebanon, who sold them, or who benefited.

- In September 2020, the World Bank requested the introduction of a direct subsidy card system, given that cross-border smuggling prevented Lebanese citizens from benefiting from subsidized goods. This was only adopted in February 2022, after which subsidies to traders were reduced and eventually entirely stopped with the onset of the dollarization.

- The social cost of corruption was catastrophic for large segments of the Lebanese population: bakeries ran out of subsidized flour, hospitals depended directly on foreign and Arab aid to obtain fuel and medicines, government institutions ceased functioning, fuel station queues stretched, and inflation soared 82 fold.

The Flaws in the Subsidy Mechanism

It is clear many exploited loopholes left in the subsidy system—originally intended as a social safety net—to reap enormous illicit profits:

- No independent authority monitored the subsidy mechanism and its implementation.

- It is unknown whether the State Council approved the mechanism and the basket of subsidized goods.

- No audits were conducted by the Ministry of Economy, Ministry of Finance, Customs, or the Central Bank.

The international community remains dissatisfied with how the subsidy policy was implemented and therefore requests Lebanon to conduct a transparent investigation of the subsidy phase, hold corrupt officials accountable, and recover stolen funds.

Will Lebanon succeed in meeting this demand, knowing that the hands of many influential figures are deeply involved in the operation? The future will answer this question.

Please post your comments on:

[email protected]

Politics

Politics