As if the financial losses and rising poverty inflicted by the crisis weren’t enough, Lebanon is now suffering its most devastating and irreversible economic and social blow: the loss of its human capital. Political failure to address the financial collapse, the war that has struck Lebanon over the past two years, and the continued deterioration of economic conditions have triggered a new wave of emigration targeting highly qualified and experienced workers. This exodus is draining one of the most critical assets of the Lebanese economy: its labor force.

A New Wave of Brain Drain

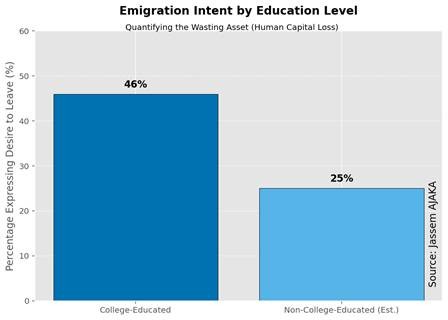

Perhaps the most alarming finding in polls conducted by Arab Barometer (arabbarometer.org) is the overwhelming desire to emigrate, especially among the educated workforce that holds the keys to future economic growth. Surveys conducted last year show that 58 percent of young people aged 18 to 29 want to leave Lebanon, while 46 percent of university graduates say they are inclined to emigrate — a far higher percentage than among those with lower levels of education.

When asked about the reasons, respondents primarily cited economic conditions (72 percent of the sample) and security concerns (27 percent), making these the main drivers of emigration. This loss directly affects vital sectors and could become a major obstacle to any potential future recovery.

Graph 1: Polling on emigration (Source: Arab Barometer)

Graph 1: Polling on emigration (Source: Arab Barometer)

Sectors Most Threatened

The Health Sector:

Lebanon has historically been a regional medical hub, giving rise to medical tourism. But since the onset of the crisis, thousands of doctors and nurses have migrated to Europe, the Gulf, the United States, and Canada. The country is losing expertise that cannot be replaced except after many years of training a new generation of medical professionals.

The Technology Sector:

Engineers and specialists in this sector are essential to any sustainable economic growth — as highlighted by the Cobb–Douglas production function — especially since Lebanon’s only competitive path forward lies in a knowledge-based economy, with its workforce as the backbone. Their departure represents a significant loss to the country’s economic future.

The Education Sector:

Low wages have pushed many teachers to leave, posing a direct threat to the quality of education, especially in fields most needed by the job market.

It is worth noting that the World Bank has warned of a “dangerous depletion of human capital” in Lebanon as a result of the economic crisis — a looming economic and social threat whose consequences will be extremely difficult to contain.

Impact on GDP and Public Finances

The exodus of highly skilled workers strikes Lebanon on two fronts: the economy and public finances.

Economically, this migration deals a severe blow to the private sector through the loss of productivity. Human capital is a primary engine of economic growth, particularly in service-based economies. Losing it means losing the ability to generate new ideas that can be marketed as products or services, and consequently losing the capacity to create jobs for new graduates. Over the long term, this translates into a decline in GDP.

This trend also affects public finances. Highly skilled workers typically earn higher incomes and fall within the upper-middle and upper-income brackets — meaning they represent an essential source of tax revenue, the backbone of state income. A decline in their numbers will inevitably lead to reduced government revenue, pushing the state to raise taxes to compensate for losses — a move that will deepen poverty.

The Positives of Remittances — But…

Remittances from Lebanese expatriates and their spending during visits to Lebanon now account for more than 30 percent of the country’s GDP. They constitute a vital source of foreign currency — which Lebanon desperately needs — and this is undoubtedly a positive factor.

However, there is a downside. Studies show that remittances are now used almost entirely to cover basic needs. They have effectively become a fragile social safety net because they fund consumption rather than strengthen Lebanon’s economic engine.

More worryingly, instead of being invested in productive projects, these funds are being spent on consumption, which means the Lebanese economy cannot grow, in line with the principle: “No investment = no growth.”

This reality also fuels the cash economy, which has placed Lebanon on the FATF “grey list.” Without meaningful banking sector reforms, Lebanon faces a fundamental dilemma: either allow continued cash inflows (risking being moved to the black list) or restrict remittances under international pressure (deepening poverty).

A Path Out of the Crisis

Ultimately, Lebanon cannot escape this impasse without structural economic and financial reforms — particularly in the public sector and the banking sector. History has shown that since the beginning of the crisis in 2019, successive governments have failed to implement the necessary reforms.

And while the state’s assets and some of the central bank’s assets are protected to some extent by legal structures that shield them — as in the case of gold — Lebanese talent is not protected by any law. As a result, the emigration of its most skilled citizens will leave long-lasting consequences, condemning the country to decades of decline until political decisions are rationalized.

Please post your comments on:

[email protected]

Politics

Politics