The global economy is flashing alarming signals, as markets show signs of unprecedented turbulence. Two of the world’s most vital commodities—gold and crude oil—have deviated from their historical paths in a manner unseen in modern economic history.

Gold has surged to historic highs, crossing the $4,200 per ounce mark and briefly nearing $4,400, while oil has plunged to multi-year lows. Brent crude fell below $61 a barrel, and West Texas Intermediate (WTI) dropped under $58.

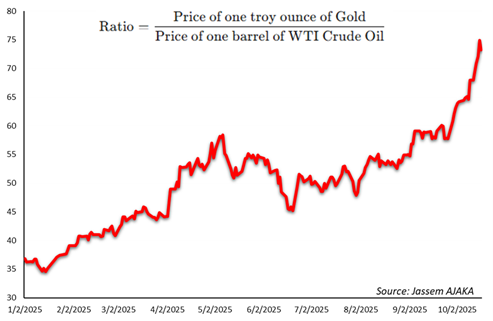

This sharp divergence has pushed the gold-to-oil ratio—the number of oil barrels needed to purchase an ounce of gold—to levels unseen since the COVID-19 pandemic at the start of the decade. Historically, this ratio rarely exceeded 18. Today, it hovers around a staggering 75.

Chart 1: Price of a gold ounce compared to the price of a barrel of U.S. oil. Source: Our calculations.

Chart 1: Price of a gold ounce compared to the price of a barrel of U.S. oil. Source: Our calculations.

Such a wide gap between gold and oil prices is less a reflection of market efficiency than a loud warning of deep-rooted economic distress. It highlights the weight of geopolitical tensions, financial uncertainty, and mounting fears of a global demand collapse.

Traditionally, gold and oil prices moved in tandem. Rising oil prices pointed to higher inflation, prompting investors to seek gold as a safe haven. What is unfolding now, however, is a breakdown of that positive correlation—an ominous sign that the global economy may be slipping toward stagflation.

Gold and the escape from the Dollar

In early 2019, gold traded at $1,300 per ounce. Today, it exceeds $4,300—an increase of 224% since then, and 58% just this year. What explains this meteoric rise?

Gold has long been the haven of choice in times of geopolitical or economic uncertainty. The surge reflects a combination of factors eroding investor confidence in traditional assets—chiefly the U.S. dollar.

De-dollarization is the first driver. Central banks, particularly in emerging markets, are buying gold at a record pace to diversify reserves and reduce dependence on the dollar. The greenback is increasingly viewed as a political tool wielded by Washington. Meanwhile, U.S. public debt has ballooned past $33 trillion, further shaking trust.

Second, monetary policy shifts have given gold a significant boost. Market expectations of rate cuts in the United States are rising, with the Federal Reserve adopting a more dovish stance amid low inflation and weak labor market indicators. Investors see a new cycle of interest rate reductions beginning this month. Lower rates reduce the opportunity cost of holding gold—an unyielding asset—making it more attractive. The message from markets is clear: gold’s surge is not a short-term spike, but part of a long-term trajectory.

Third, geopolitical risks are pushing investors into gold. The Russia–Ukraine conflict, escalating U.S.–China trade tensions, and even domestic political gridlock in Washington have all heightened risk aversion.

Chart 2: Historical data of gold (right) and the U.S. dollar index (left). Source: Investing.com

Chart 2: Historical data of gold (right) and the U.S. dollar index (left). Source: Investing.com

Oil’s Collapse and Global Demand Shock

At the same time, crude oil’s steep fall tells another story—that of collapsing demand for the world’s most strategic commodity.

The drop in oil signals a serious decline in global economic activity. China’s industrial slowdown, driven by U.S. tariffs and Beijing’s own restrictive measures, has cut into production and investment. The accelerating shift toward clean energy, particularly in transportation, also suggests that demand in key sectors is no longer sustainable.

Chart 3: Historical data of U.S. oil. Source: Investing.com

Chart 3: Historical data of U.S. oil. Source: Investing.com

On the supply side, abundant U.S. shale output and OPEC+’s inability to sustain production cuts have created a glut, with surplus approaching one million barrels per day. This oversupply continues to push prices downward.

The Stagflation Threat

The breakdown in the gold–oil correlation is perhaps the clearest warning yet: the global economy risks sliding into stagflation.

Soaring gold prices signal financial instability—not only in sovereign debt markets but also in the value of major currencies. At the same time, collapsing oil prices point to shrinking demand, faltering industrial output, and collapsing investment.

In short: inflationary pressures on one side, economic contraction on the other—a toxic combination that could trap the world in a stagflationary spiral.

Please post your comments on:

[email protected]

Politics

Politics