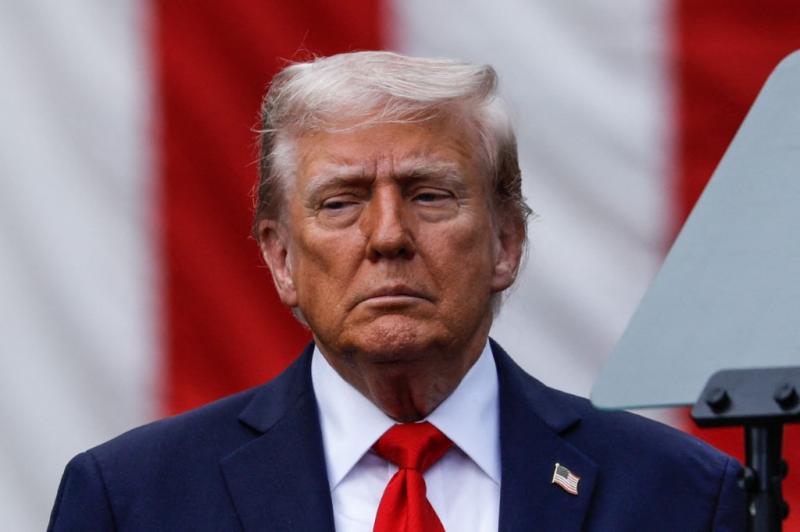

In modern U.S. history, few public clashes between a president and a central bank chief have reached the intensity of the standoff between Donald Trump and Federal Reserve Chair Jerome Powell—whom Trump himself appointed in 2017. While Trump has accused Powell of playing partisan politics, the conflict goes much deeper: it’s a battle over the very independence of the U.S. Federal Reserve, with significant implications for the American economy and, by extension, the global financial system. After all, the U.S. economy accounts for more than a quarter of global GDP.

The Core of the Conflict

Trump’s economic vision hinges on lowering interest rates to reduce the cost of servicing the U.S. national debt—nearly $1 trillion—and to stimulate domestic growth. He believes that lower rates would enhance American companies’ competitiveness, especially as his protectionist policies seek to revive U.S. manufacturing and meet domestic demand.

But Powell has resisted, arguing that interest rate policy must be dictated by economic data, not political pressure. In defiance of Trump's increasingly personal attacks—including calls for Powell’s resignation and even a federal investigation into renovations at the Federal Reserve building—Powell has stood firm, invoking the Fed’s institutional independence.

Why Central Bank Independence Matters

Economists broadly agree: central bank independence is vital for sound economic governance. It protects monetary policy from short-term political manipulation, particularly in election cycles where the temptation to stimulate the economy at any cost can be overwhelming.

A credible central bank helps anchor inflation expectations among investors and consumers. When markets believe the Fed will do what it says—free from political interference—it stabilizes the economy. But when political pressure erodes that credibility, inflation expectations become unmoored, triggering harmful economic cycles.

Examples abound: Lebanon’s 2020 collapse was accelerated by tensions between the government and Central Bank Governor Riad Salameh. Similarly, Turkish President Recep Tayyip Erdoğan’s confrontations with his central bankers have had devastating effects on the Turkish lira.

Even if Powell maintains his position, the public nature of the conflict with Trump could have far-reaching effects:

1. Increased Market Volatility

Markets operate on expectations. A high-profile feud between the president and the Fed chairman increases perceived systemic risk, prompting capital flight and asset mispricing. As a result, companies could face higher borrowing costs, reduced investment, and slower job creation—all of which threaten U.S. and global growth.

2. Weakened Policy

Doubts about the Fed’s independence may lead markets to discount its forward guidance. If investors believe the Fed’s decisions are politically motivated, monetary policy loses its effectiveness. This would severely limit the Fed’s ability to steer the world’s largest economy—potentially triggering global instability.

3. Eroding Inflation Control

The Fed follows a "targeted inflation" model, which requires high-level macroeconomic analysis and credibility. An open political battle could undermine market confidence in the Fed’s ability to manage inflation, fueling artificial price increases. This could trigger a vicious cycle—rising wages, higher costs, escalating prices—ultimately leading to economic stagnation, the opposite of what Trump intends.

4. The Dollar's Dominance at Risk

More than 60% of international trade is conducted in U.S. dollars. The dollar also dominates currency exchange markets and is the top reserve currency for central banks worldwide. A prolonged Trump–Powell conflict could damage the dollar’s global standing, especially as BRICS countries push to break the dollar’s monopoly in international trade. A decline in demand for dollar-denominated assets could weaken the greenback significantly, especially given the U.S.’s soaring debt and budget deficit.

A Global Domino Effect

BRICS nations—already exploring a new trade currency to rival the dollar—would likely welcome a Trump–Powell showdown. But the collapse or destabilization of the U.S. economy, due to its sheer scale, would have catastrophic consequences for other economies. That’s why this confrontation is not just a test for U.S. institutions but a global referendum on central bank independence.

The economic science is clear: a politically independent central bank is essential for credible, sustainable monetary policy and long-term economic stability.

So, will Trump succeed in bending the Fed to his will? Will Powell be forced to resign to avoid a deeper rupture? Or is there still a way out of this standoff without shaking the pillars of global finance?

Please post your comments on:

[email protected]

Politics

Politics