The “Big Beautiful Bill” is Donald Trump’s economic policy initiative, representing a major shift in U.S. economic strategy. This project rests on three main pillars: tax cuts, trade protectionism, and domestic spending (see Chart 1). The proposal has deeply divided Americans—even within Trump’s own circle (Elon Musk being a prime example)—with some seeing it as a bold, clear plan, and others as a reckless gamble.

In this article, we shed light on the project’s positives, negatives, and its potential consequences for both the U.S. and the global economy.

Chart 1: The three main pillars of Trump’s “Big Beautiful Bill”

Chart 1: The three main pillars of Trump’s “Big Beautiful Bill”

Tax Cuts

The core of Trump’s project is a significant reduction in corporate taxes across all sectors and in personal income taxes for every segment of American society. Notably, the 2017 Tax Cuts and Jobs Act (TCJA 2017) had already dramatically lowered taxes, and Trump’s plan proposes to extend this reduction further.

According to the proposal, these tax cuts would spur economic growth by encouraging investment, creating jobs, and consequently boosting consumer spending. However, Trump faces resistance from Federal Reserve Chairman Jerome Powell, who refuses to lower interest rates due to concerns about inflation—reasons Powell frames as economic, but which Trump claims are politically motivated. Thus, an open standoff looms between the two men.

Trade Protectionism

The second key pillar of Trump’s “Big Beautiful Bill” is protective trade measures, such as imposing higher tariffs on imported goods and banning imports from certain sources. Trump justifies these measures as necessary to protect American industry and agriculture from what he calls “unfair competition.” According to Trump, this would revitalize U.S. manufacturing and agriculture by encouraging domestic production and forcing companies to relocate factories to the U.S. after decades of relying on cheaper production abroad.

Domestic Spending

The third core pillar involves allocating substantial funds for national security, including building border walls—particularly along the Mexican border—and increasing budgets for enforcing immigration and deportation laws. Trump argues this would protect American jobs and resources from illegal immigration, aligning with his “America First” doctrine.

Positives and Negatives of the Project

There is no doubt Trump’s plan has both positive and negative aspects, which will materialize depending on how events unfold. These can be summarized as follows (see Chart 2):

Chart 2: Positives and negatives of the “Big Beautiful Bill”

Chart 2: Positives and negatives of the “Big Beautiful Bill”

Positives: Trump bases the project’s benefits on several economic theories supporting his stance, foremost among them “supply-side economics,” which argues that expanding the supply of goods and services stimulates economic growth more effectively than focusing on demand—achieved through tax cuts, economic deregulation, and reducing government spending.

Trump also leans on the “Laffer Curve,” which suggests there is an optimal tax rate that maximizes government revenue by lowering taxes enough to boost economic activity, thereby increasing tax revenues in absolute terms.

Furthermore, Trump’s plan invokes mercantilist theory, advocating tariffs and local industry subsidies to protect domestic producers from foreign competition and help them grow into major economic players.

To curb spending, Trump draws from fiscal conservatism, which calls for reduced government expenditure—and consequently lower public debt—arguing that “government spending is inherently inefficient and competes with private investment.”

He also invokes nationalism and economic sovereignty, justifying prioritizing Americans and U.S. interests above all else.

Together, these elements aim for three main outcomes: increased economic growth, job creation, and correcting trade imbalances.

Negatives: Critics argue that tax cuts disproportionately benefit the wealthy over low-income earners, worsening income inequality. They warn that public debt could swell without guaranteed economic growth or job creation. Opponents also say trade protectionism could trigger trade wars, raise consumer prices in the U.S., and slow the global economy, given America’s share of over a quarter of global economic activity.

Additionally, they caution that spending cuts will primarily hit social programs essential for sustaining long-term growth. Some economists warn that disrupting global supply chains could destabilize the current trade system, create significant uncertainty, and push many countries and economic blocs to pursue self-sufficiency at the expense of U.S. interests.

Based on various scenarios, the likelihood of ballooning public debt is high—a major sticking point between Trump and Musk, who have publicly sparred on social media over the issue.

Macroeconomic Simulation

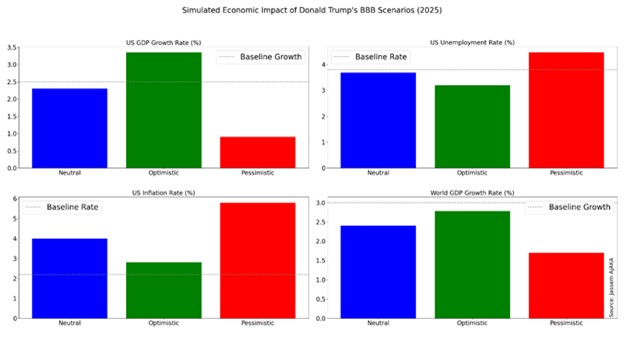

Three scenarios are projected for Trump’s bill: optimistic, pessimistic, and status quo. Chart 3 shows potential trends in U.S. economic growth, inflation, and unemployment, as well as global economic growth under these scenarios. While calculating probabilities requires hundreds of complex equations and vast data resources, we offer this simplified snapshot of how the U.S. and global economies might evolve.

Chart 3: Simulation of U.S. economic growth, inflation, and unemployment under three scenarios (Source: Author’s calculations)

Chart 3: Simulation of U.S. economic growth, inflation, and unemployment under three scenarios (Source: Author’s calculations)

In conclusion, it can only be said that Trump’s plan may saddle the United States with further deficits and public debt, much like during his first term. In 2019 alone, the budget deficit hit one trillion dollars, and Trump’s first term ended in early 2021 with a staggering $7.8 trillion increase in public debt, bringing it to $28 trillion total—effectively burdening every American with $23,500 in debt.

Please post your comments on:

[email protected]

Politics

Politics