Expert Mathieu Berrurier analyzes the impacts of maritime transport risks on insurance premiums, inflation, and global growth.

Since the beginning of the Houthi guerrilla warfare in the Red Sea, traffic through the Suez Canal has slowed down. How have insurance premiums for super tankers and oil tankers behaved?

The conflict in the Red Sea and the Gulf of Aden is closely monitored by insurers specializing in War Risks, as are all conflict zones globally, whether armed conflicts or politically sensitive or unstable areas. Beyond the initial reaction to the war risk surcharges being charged, it is interesting to focus on the essential role insurers play in risk assessment during these periods of armed conflict. Indeed, the information they have during these crises and the experience they have gained through armed conflicts over the last 30 years give them a very fine perception of the nature and intensity of these conflicts. Better than anyone, "RG" insurers have the ability to analyze the severity of a geopolitical crisis situation and perceive its scope. To answer your question; with more than 20,000 ships crossing the Suez Canal each year (between 15 and 20% of global traffic), the Houthi guerrilla warfare in the Red Sea and the Gulf of Aden has profoundly disrupted traffic in this area of intense passages between Asia and Europe. Very quickly, the media relayed Houthi shootings off the coast of Yemen, on several container ships that could carry goods for the Israeli state. Very quickly, too, insurers reflected the aggravation of risks they had finely analyzed by increasing the premiums for all ships passing through the "war zone" they had delimited. Thus, oil tankers, super tankers, container ships, or other vessels are all subject to the same surcharges, as insurers are currently unable to distinguish based on the types of ships. However, war risk insurers clearly distinguish between ships and the goods they carry. Cargoes are also subject to significant "war risk" surcharges during conflicts like the one observed in recent weeks between the Suez Canal and the Bab al Mandad Strait. But perhaps we'll come back to that.

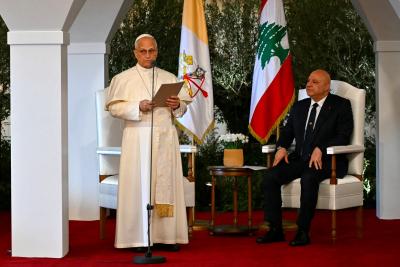

Mathieu Berrurier, General Manager of Eyssautier-Verlingue and President of the Union of Marine and Transport Insurance Brokers (UCAMAT).

Mathieu Berrurier, General Manager of Eyssautier-Verlingue and President of the Union of Marine and Transport Insurance Brokers (UCAMAT).

Another conflict, the one in Ukraine, has made the Black Sea less safe. How did insurers evaluate the risks there?

Whether we're talking about maritime piracy, war risks, or political risks, no conflict is like another. Somali pirates hijacked ships in the Indian Ocean and demanded ransoms to release the crew, while pirates in the Gulf of Guinea, more violent and very active at the moment, loot and rob the ships and crews they attack. Similarly, the conflict in Ukraine has made the Black Sea a war zone assessed by insurers as a "high-risk" area, very dangerous for navigation, and heavily suppressed, where the Red Sea is currently considered by insurers as a less severe area. Let me explain. The Black Sea is a closed sea, and ships enter to load or unload in ports. It is a destination risk, and the enemy military power is none other than Russia. The Red Sea is a transit zone, where ships sail offshore without stopping. It is a transit risk, with the enemy forces being Yemeni rebels, whose armament remains relatively "limited." Therefore, it is not surprising that the risk assessment by insurers is incomparable between the Black Sea and the Red Sea, even if the surcharges billed for ships transiting through the Red Sea can already be 10 to 20 times higher than the basic RG premiums. (very moderate premiums). In the gradation of risks that our insurers are able to assess, areas like the Black Sea are subject to a mandatory prior declaration imposed on each ship planning to navigate there, and surcharges can go up to 100 times the basic annual premium!

Can these extra costs for shipowners impact the price of goods and reignite inflation?

Yes, it is evident that these extra costs have an impact on the price of goods and the final consumer, even if the origins of these extra costs are diverse. In a conflict like the one in the Red Sea and the Indian Ocean, the shipowner must add, for example, the risk premiums paid to crews passing off the Yemeni coast to the "moderate" increase in war risk premiums for ships crossing this risk area. Similarly, for shipowners who have chosen not to expose their crews by avoiding the passage through the Suez Canal, the detour around the African continent via the Cape of Good Hope also entails significant extra costs. Indeed, the cost of goods is strongly impacted here by an additional fifteen days at sea, inducing a significant increase in transport costs, crew salaries, not to mention the ensuing delays. The shipowner must then arbitrate between risk management and cost management. But, in any case, the extra cost will be passed on to all actors in the transport chain (shipowners, charterers, shippers, intermediaries, etc.) Ultimately, the direct impact on the price of goods is currently limited, consumers will only be slightly affected, and the effects observed to date cannot be the cause of a "re-ignition of inflation."

Which industries are handicapped by the extension of maritime shipping delays?

There has been a lot of talk about the conflict with the Houthi in the Red Sea and the detour to the south of Africa. Although it currently does not concern as many ships, it does affect almost all container transport. The shutdown of Tesla factories due to a break in its supply chain of parts from Asia has often been cited, and I confirm that many other industries have been and will be impacted by the extension of maritime shipping delays. It is important to understand that beyond the extension of about fifteen days for maritime transport passing through the Cape of Good Hope, there is the total disorganization of the flow of goods unloaded in the destination ports and then redistributed with amplified delays. Therefore, all industries concerned by the traffic threatened by this new conflict are already affected, and if the conflict were to prolong and/or worsen, more severe consequences would be observed and would inevitably generate inflation.

The presidential election in Taiwan saw the election of a pro-independence candidate. Beijing still claims this island, a major producer of semiconductors. Have insurers already increased premiums for maritime transport?

No, not yet to this day, even if insurers are on the lookout and follow the evolution of the situation like "milk on the fire." In a scale of risk gradation carefully established by war risk insurers, the South China Sea and the navigation zones around the island of Taiwan are not currently suppressed. Insurers allow merchant ships to navigate freely there until an incident occurs and leads them to review the situation overnight. In this case, following a system that applies to all war risk contracts insuring ships or goods, the sudden degradation of risks in a conflict zone can lead insurers to suspend their guarantee at any moment, while still respecting a notice period set in advance by the parties. (between 24 hours and 7 days). When such a situation arises, all journeys started remain covered against war risks until their final destination. However, any new journey must be declared in advance to the insurers, who will then have the choice; either to refuse their guarantee; or to grant it punctually in exchange for a surcharge to be determined. Depending on the insurers and the markets, this is the current situation for journeys transiting through the Red Sea and the Gulf of Aden. As soon as insurers deem that the geopolitical situation of the "surcharged" area returns to normal, the basic annual war risk contract applies again. In between, without talking about high war risk surcharges, our insurers may decide to maintain increased pricing in areas where they consider the risk of occurrence of a related claim remains high. This is the case, for example, for navigation in the Persian Gulf.

Overall, doesn't the multiplication of regional conflicts become a structural factor of inflation through the increase in production costs linked to the increase in insurance?

Yes, you are absolutely right, but I would like to point out that the increase in insurance is just one structural factor among many that could justify the increase in costs and therefore the resurgence of inflation. What seems obvious to me, however, is that the multiplication of regional conflicts you mention leads to a total disorganization of the flow of goods transported worldwide. With more than 80% of goods transported by sea, the multiplication of these conflict zones has a strong and direct impact on the organization of the "Supply Chain" of all global economic actors. Detours, port congestion, delivery delays, supply breaks leading to production breaks..., everything we experienced during and after the COVID health crisis will potentially become structural and recurring crises as global geopolitical tensions intensify.

(*) General Manager of Eyssautier-Verlingue and President of the Union of Marine and Transport Insurance Brokers (UCAMAT).

Please post your comments on:

[email protected]

Politics

Politics