Lebanon’s draft budget for 2026 reveals ambitious targets to boost state revenues. Total projected revenues are estimated at 505.7 trillion Lebanese pounds—a 13.6% increase compared to the 2025 budget (445.2 trillion) and a staggering leap from the mere 18.8 trillion recorded in 2021. The lion’s share of this increase comes from taxes, which are expected to generate 416.1 trillion pounds, up 15.1% from 2025 and representing nearly 82% of total revenues.

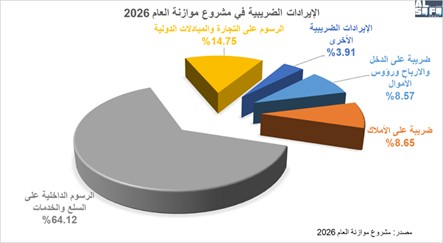

Among the main sources of this surge (see Chart 1):

Domestic taxes on goods and services: By far the largest component at 266.8 trillion pounds, this item is set to rise 31% compared to 2025, reflecting improved collection and crackdowns on tax evasion, especially at maritime, land, and air facilities.

Income, profit, and capital taxes: Rising by 19% to 35.7 trillion pounds, indicating both stronger tax collection and a broader tax base.

Non-tax revenues: Growing at a more modest pace of 7%, reaching 89.6 trillion pounds. Public administration fees (63.3 trillion) remain the main contributor outside tax income.

By contrast, customs revenues from international trade are projected to fall 16%, a decline that may point to a protectionist turn. The 2026 draft grants the government legislative powers over tariffs until 2030. Mixed non-tax revenues also dropped by more than 50%, signaling a possible policy shift away from unstable revenue streams.

Taken together, these figures highlight a structural pivot toward effective tax collection—a crucial shift six years after the economic crisis crippled the state’s ability to raise funds. Yet, while the Finance Minister’s effort to draft a revenue-oriented budget is notable, the challenge goes beyond legal fixes. Achieving these targets will demand institutional reform, public trust, and above all, the state’s actual ability to enforce tax collection.

Chart 1: Tax Revenues in the 2026 Draft Budget (Source: 2026 Draft Budget)

Chart 1: Tax Revenues in the 2026 Draft Budget (Source: 2026 Draft Budget)

Spending Priorities: Heavy on Salaries and Social Aid

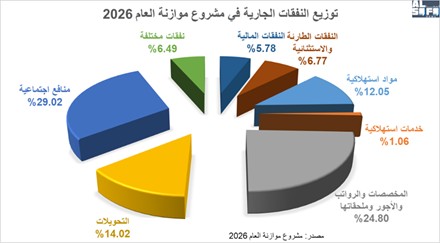

On the expenditure side, current spending accounts for 89% of total expenses—an improvement over past decades when it hovered around 94%. Still, current expenditures amount to 449.6 trillion pounds, forming the backbone of the budget and the heaviest burden on the treasury. Key components include (see Chart 2):

Salaries, wages, and related benefits: 111.5 trillion pounds, or nearly a quarter of current spending, reflecting the size of the public wage bill despite repeated IMF warnings that the state cannot sustain it.

Transfers: The second-largest item at 63 trillion pounds, covering subsidies to public institutions, direct sectoral support, and transfers to external parties—items that typically lack transparency.

Social benefits: At 130.5 trillion pounds (over 29% of current spending), this includes subsidies for basic goods, cash assistance, and health and social care—underlining the state’s role as a social safety net amid economic collapse.

Consumables: Daily government purchases worth 54.2 trillion pounds, indicating the administration’s intent to maintain normal operations despite the crisis.

Service-related expenses: A modest 4.8 trillion pounds covering rent, maintenance, communications, and postal services—levels that could mean reduced public services or a shift toward administrative digitalization.

Financial and miscellaneous expenses: Together amounting to 55.2 trillion pounds, split between financial outlays (26 trillion) and miscellaneous costs (29.2 trillion), covering external debt servicing (excluding Eurobonds) and indirect operating costs.

Emergency and exceptional spending: 30.5 trillion pounds earmarked for crisis management—necessary but also a sign of weak long-term planning.

Chart 2: Distribution of Current Expenditures in the 2026 Draft Budget (Source: 2026 Draft Budget)

Chart 2: Distribution of Current Expenditures in the 2026 Draft Budget (Source: 2026 Draft Budget)

Key Takeaways

Three main items—salaries, social benefits, and transfers—consume more than 75% of current spending, leaving little room for development or investment. The budget focuses on administrative and social survival, not growth.

Program laws have been deferred from 2026 to 2027 (with few exceptions), confirming that the budget does not aim at reconstruction or infrastructure development, but merely halting further collapse.

Effective tax collection remains the decisive factor. Without it, expenditures will only translate into new deficits and mounting debt.

Public debt issues remain unaddressed, including Eurobond obligations and domestic debts tied to depositors’ funds.

The budget overlooks Iraq’s claims on Lebanon for fuel—valued at nearly $2 billion and held in Lebanese pounds.

IMF recommendations to restructure the public sector (institutions and employees) were ignored, as reflected in high current spending.

Critically, the absence of audited financial statements from 2004 to 2024 undermines the budget’s credibility and prospects for restoring fiscal balance.

Conclusion

The 2026 draft budget marks a significant step toward improving Lebanon’s revenues—something unseen in the country’s budgets this millennium. But the spending side tells a different story: this is not a budget for recovery. Instead, it is a socially-oriented plan designed to cushion collapse, reflecting decades of flawed fiscal policy and compounded by the political paralysis that continues to block genuine reform.

Please post your comments on:

[email protected]

Politics

Politics