Tensions between Iran and the West have flared once again over Tehran’s nuclear program. After several rounds of talks between Iranian officials and European Union representatives, the EU failed to convince Tehran to allow International Atomic Energy Agency inspectors access to its nuclear facilities. This prompted Germany, Britain, and France to send a letter to the UN Security Council demanding the reactivation of the so-called “snapback” sanctions mechanism.

The snapback provision, embedded in the 2015 nuclear deal, allows the United States, Russia, China, France, Britain, and Germany (the P5+1) to swiftly reimpose UN sanctions on Iran within 30 days if Tehran is deemed non-compliant. Once triggered by a formal letter to the Security Council, the process cannot be blocked by any veto from the permanent members.

These UN sanctions, legally binding on all member states, would prohibit Iran from accessing conventional weapons, ballistic missile technology, and nuclear materials. They also target banking, transportation, and oil sectors, while freezing Iranian assets abroad. The measures would come on top of unilateral sanctions already enforced by the U.S. and EU. Tehran blasted the European move as “unjustified and illegal,” threatening retaliatory steps.

Three Possible Scenarios

1. Limited Impact

In the first scenario, the reimposition of sanctions would have symbolic weight but minimal effect, particularly if major buyers like China and India refuse to comply. Both countries are heavily reliant on Iranian crude and could continue purchasing it via Tehran’s “shadow fleet.” Europeans view this as a means to increase pressure without crippling the Iranian economy, aiming to push Tehran back to the negotiating table. The global impact would be mild—only a slight increase in oil prices, which would be easily offset by other producers.

2. Moderate Fallout

A second scenario envisions broader compliance with the sanctions by many states. This would significantly strain Iran’s economy, especially its oil exports—the main source of hard currency. Inflation would spike, the rial would depreciate further, and budget deficits would widen, deepening social hardship. Globally, oil markets would feel the pinch, with prices rising more sharply despite higher output elsewhere. But the greatest risk here lies in geopolitics, as tensions escalate.

3. Escalation and Confrontation

The third—and most dangerous—scenario involves an aggressive Iranian response. Tehran could suspend diplomatic cooperation, quit the Nuclear Non-Proliferation Treaty, accelerate uranium enrichment, or even threaten military action by closing the Strait of Hormuz or tightening controls on shipping. Such moves would likely provoke a severe Western response, possibly a joint U.S.-European-Israeli military buildup. Oil prices could soar, global supply chains would be disrupted, and Iran would face near-total economic isolation, with hyperinflation, shortages of food and raw materials, and a collapse in growth. The broader global economy would also suffer: higher energy costs could stifle growth in major economies, while disruptions in Gulf exports might ironically benefit sanctioned producers like Russia and Venezuela if their oil re-enters markets.

By the Numbers

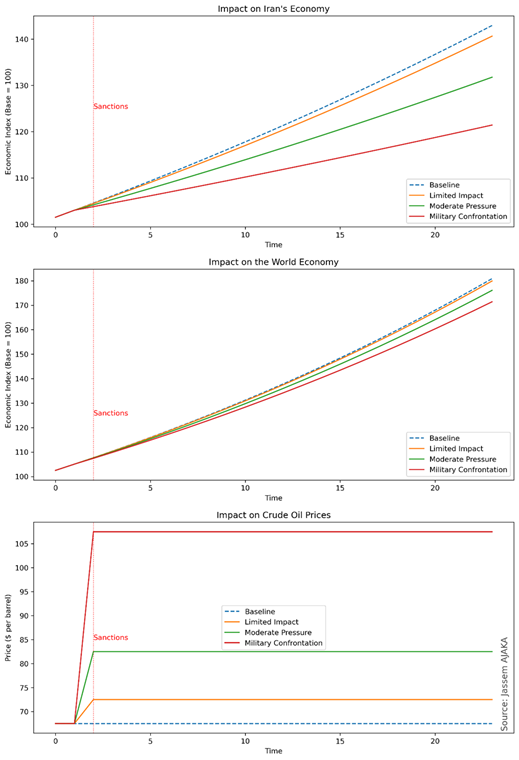

Economic simulations (see Figure 1) suggest the third scenario would be the most catastrophic. Global growth could fall by 1 percentage point from a baseline of 2.5%, driven by a surge in oil prices of more than $25 a barrel if Gulf exports through Hormuz are cut off. Such a crisis could trigger a major geopolitical reset in the Middle East.

For Iran, the consequences would be devastating: a 20-point drop in growth relative to its modest baseline of 1.5%, compounded by deep social costs and damage to infrastructure.

Figure 1: The implications for both the Iranian and global economy, as well as oil prices, under the three scenarios (Source: our calculations).

Figure 1: The implications for both the Iranian and global economy, as well as oil prices, under the three scenarios (Source: our calculations).

Likely Outcomes

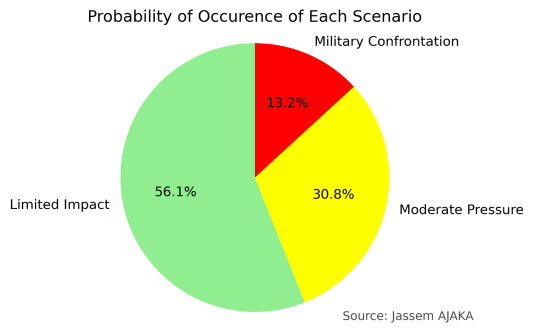

Projections (Figure 2) suggest the first scenario, with limited consequences, remains the most probable. Simulations running 10,000 iterations confirm that outcome. However, military analysts warn that Israel, backed by the U.S. and Europe, might pursue preemptive strikes on Iran. This would edge reality closer to the third scenario, though economic pain might be cushioned by preemptive global measures, such as reopening markets to Russian oil.

What is certain is that diplomacy has a narrow 30-day window in which reason may prevail over force. Whether that opportunity is seized will determine if the world faces mild economic turbulence or a full-blown crisis.

Figure 2: Simulation of the probability of each of the three scenarios (Source: our calculations).

Figure 2: Simulation of the probability of each of the three scenarios (Source: our calculations).

Please post your comments on:

[email protected]

Politics

Politics