It was an unimaginable scene. After more than a decade of isolation, Syria’s central bank has just completed its first SWIFT transaction—the global financial messaging system used by Western banks—in fourteen years. The transaction, conducted with an Italian financial institution, is a clear signal that Syria may be returning to the international fold through the door of the global financial system.

Sanctions on Syria

Since 2011, when the Syrian revolution began, Syria, its economy, and its banking system have been under severe U.S. and European sanctions in response to the previous regime’s actions and human rights violations during the civil war. The conflict and these sanctions pushed much of the Syrian population to the brink of poverty. According to the World Bank, more than 90% of Syrians live below the poverty line (less than $2.13 a day). The Syrian economy suffered a massive collapse during this period. The country’s financial isolation paralyzed its economy, disrupted trade with the outside world, and halted foreign direct investment, losses estimated at over $800 billion. To work around this isolation, which affected both commercial banks and the central bank, Syrians relied heavily on Lebanon and its banking sector as a logistical base for importing essential goods, transferring funds abroad, and receiving money from overseas.

Today, with the fall of the previous regime and the lifting of sanctions, new and promising economic opportunities are opening up for Syria. But these prospects hinge on the new government’s ability to regain control over Syrian territory, restore security, expel extremist groups, and guarantee the rights of minorities.

Beyond Symbolism: A Pivotal Step

The first SWIFT transaction since the lifting of sanctions is more than symbolic. It’s an essential condition for Syria’s reintegration into the global financial system, paving the way for direct trade between Syrian and foreign companies without needing to go through Lebanon. If security can be restored, foreign investments—vital for Syria’s economic revival and potential reconstruction—could be encouraged. This, in turn, would bring much-needed hard currency into the country via remittances from Syrian expatriates and new capital injected into the banking sector. The result would be a stronger Syrian pound and a boost to the central bank’s foreign currency reserves. The possibility of foreign banks opening branches in Syria would further strengthen confidence and support the inflow of foreign capital.

Conditional Promises

Of course, several critical conditions are attached to these economic promises—some political, as already mentioned, and others economic:

First: Measures to stabilize the macroeconomy. This includes restoring public finances through a fair tax system to boost revenues and cut wasteful spending. It also means stabilizing the Syrian pound by fighting inflation and implementing effective monetary policy, with genuine independence for the central bank. The government will need to negotiate with creditors to ease the burden of public debt servicing.

Second: Rule of law and institutional governance. The Syrian government must establish a legal framework (under judicial oversight) to enforce laws, particularly economic laws, including the enforcement of contracts, protection of property rights, anti-corruption measures, greater transparency, and banking sector reforms.

Third: A dynamic private sector, which is the engine of growth in free economies. This means freeing markets from state control, abandoning the socialist model, and embracing market mechanisms based on competition and openness to the world. It also requires improving business environment laws and securing support from international financial institutions to fund small and medium enterprises, the key tool in the fight against poverty. Achieving this will demand major investments in infrastructure, funded by regional and international aid and loans.

Fourth: Prioritizing social sectors such as education, health, and social protection programs, and creating jobs through reconstruction projects. The return of Syrian refugees from neighboring countries is both a moral and national duty of the new Syrian government. Crucially, these returnees could play a major role in rebuilding their country’s economy once reconstruction begins.

A Simulation of Syria’s Economic Growth

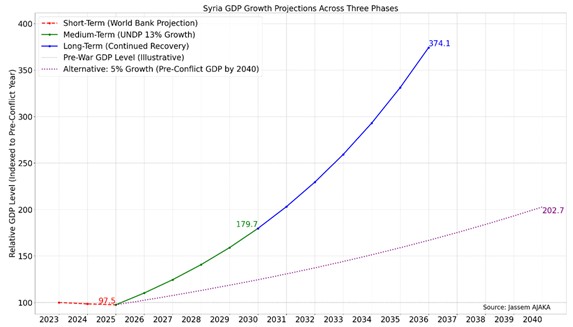

While the reforms needed are extensive and will take considerable time, projections suggest that Syria’s GDP could quadruple over ten years if reforms are implemented, highlighting the immense potential ahead. Our short-term simulation aligns with World Bank forecasts, which predict the Syrian economy will contract by 1% this year, following a 1.5% decline last year due to lack of investment, cash shortages, and fuel scarcity. In the medium term, we based our scenario on the UN Development Program’s vision, which assumes ambitious policies and Arab and international support for Syria. That program forecasts average annual growth of about 13% through 2030. By 2035, the Syrian economy is expected to fully recover, regaining its pre-crisis GDP levels (see Chart 1).

Illustration 1: Projected Syrian economic growth in the short, medium, and long term.

Illustration 1: Projected Syrian economic growth in the short, medium, and long term.

There is no doubt that the challenges facing Syrian officials are enormous. This historic opportunity now available to the Syrian people is due to their resilience, and also to Saudi support, which enabled the lifting of sanctions and Syria’s return to the international stage. The question is: will the new Syrian government succeed in meeting these challenges and carrying out a ten-year reform plan to restore Syria’s pre-war economy?

Please post your comments on:

[email protected]

Politics

Politics