Lebanon’s banking sector is grappling with a severe crisis marked by a total loss of public trust from all stakeholders, a critical shortage of liquidity—both in foreign currencies and in Lebanese lira—a sharp decline in the value of assets and deposits, and restrictions on funds deposited before October 2019. The absence of any effective response, whether from the official authorities or the banking sector itself, has led banks to abandon many of their key roles, chiefly among them the financing of both investment and consumption in the economy. More alarmingly, a parallel market for foreign currency has emerged and expanded at a terrifying pace, transforming into a full-fledged cash economy. This prompted the international community to place Lebanon on the grey list, further isolating the country financially after its default on debt payments in both foreign currencies and, later, in Lebanese pounds.

Previous governments failed—or were unable—to take the necessary steps to prevent or at least mitigate the crisis, leaving the Lebanese market to fend for itself. A series of poor decisions by officials, characterized by irrational fiscal miscalculations and a lack of objective logic and constraints, further complicated the situation and turned Lebanon into a pawn caught in the eye of a regional storm.

With renewed political momentum following the election of a president known for his integrity, the appointment of a prime minister from outside the traditional political establishment, significant military developments resulting from recent conflict, and mounting international pressure, the government rushed to adopt so-called “reform laws.” However, these initiatives lacked a coherent methodology and appeared primarily designed to satisfy the IMF’s demands. Worse still, politics and personal score-settling infiltrated the reform process, evident in the superficial debates surrounding legislative proposals with profound implications for the country’s economic and institutional structure.

Setting aside the intricacies of Lebanese politics, all proposed solutions should be examined through a clear methodological framework that facilitates decision-making and brings stakeholders closer to consensus.

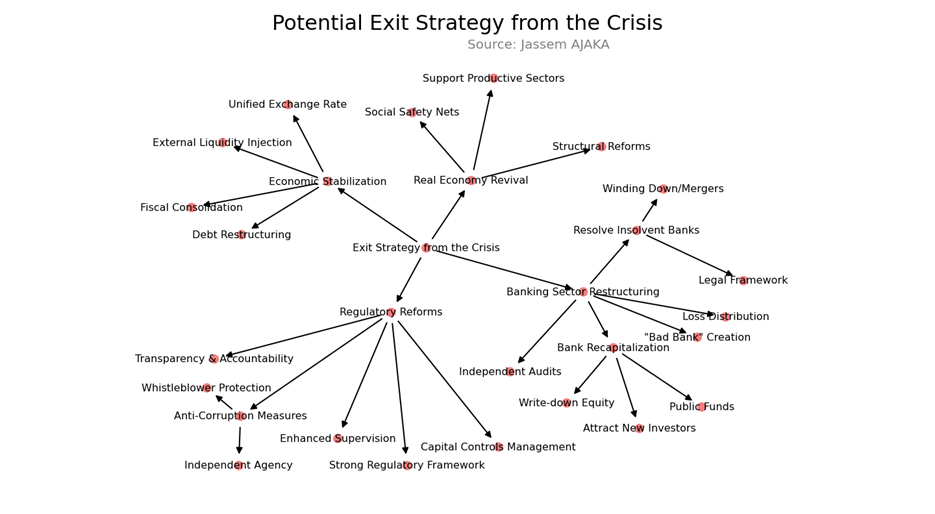

It is not possible to view a crisis that has devastated the entire banking sector, crippled public finances, and destabilized the national currency as anything but systemic. The entire economic system was hit by a series of actions—intentional or not (a determination the judiciary must make)—that began in public finance and spread to the banking and monetary sectors. Therefore, any legal proposal must be part of a comprehensive plan to restore order to the economy, public finances, the banking sector, and the currency (see diagram).

The proposed methodology divides the necessary steps into four categories:

1. A Comprehensive Plan to Restore Economic Stability

This includes restoring fiscal balance, restructuring public debt, unifying exchange rates, and injecting liquidity into the market.

Economic theory holds that long-term fiscal sustainability is not measured by the budget deficit but by the primary balance, which must exceed debt servicing costs. This is justified by the basic fiscal equation:

Public Spending + Debt Servicing = Taxes + Treasury Issuances

In Lebanon’s case, the government increased public spending (mainly on wages and subsidies to Electricité du Liban) amidst economic stagnation, with no corresponding increase in tax revenues. This widened the gap between economic growth and interest rates on public debt, forcing the state to ramp up treasury issuance (i.e., accumulate more debt), which in turn raised debt servicing costs to unsustainable levels, eventually prompting the government to suspend payments. Therefore, reducing public spending, improving tax collection efficiency, and restructuring public institutions (especially Electricité du Liban) are essential.

As for public debt restructuring, the government needs a clear vision for negotiations with creditors, emphasizing debt sustainability and ensuring fairness across all stakeholders, particularly avoiding the unjust burdening of depositors.

On the liquidity front, Lebanon urgently needs capital to finance investment and consumption. This could be achieved through:

- International financial aid (contingent on an IMF agreement);

- Redirecting cash circulating in the informal market back into the banking system (amid international scrutiny over the legitimacy of funds);

- Selling some state or Central Bank assets (such as gold);

- Financial contributions from the Lebanese diaspora.

- Restoring liquidity is vital to rebuilding confidence in the financial system and revitalizing the banking sector.

- Unifying the exchange rate is the final and most critical step toward stability. It requires a careful and coordinated monetary and fiscal policy, aligned with a resolution to the depositors’ crisis and the adoption of a capital control law.

2. Restructuring the Banking Sector

This involves independent audits (a cornerstone of trust), fair loss distribution, recapitalization of viable banks, resolution of insolvent institutions, and the creation of Special Purpose Vehicles (SPVs) to absorb and repackage non-performing loans as financial instruments for market trading.

Audits must be transparent, independent, and encompass both the Central Bank and commercial banks to accurately assess losses and rebuild financial statements that reflect reality.

"Fair loss distribution" must not be distorted by personal interests. It should be either the result of an agreement between the key stakeholders (the state, the Central Bank, banks, and those who benefited from subsidies or corruption) or decided by the judiciary.

As for recapitalizing viable banks, a detailed strategy is required. In theory, this can include:

- Capital injections from existing shareholders;

- Attracting new investors;

- Use of public funds under strict governance and clearly defined terms.

For insolvent banks that cannot be salvaged, there must be a clear legal framework and practical mechanism for liquidation or merger, while safeguarding depositors’ rights.

Additionally, the establishment of a dedicated SPV for non-performing loans would allow banks to focus on economic financing and facilitate the transformation of bad debt into tradable financial products.

3. Restoring Trust and Preventing Future Crises

This includes building a strong regulatory framework, reinforcing Central Bank independence and oversight authority, enhancing internal controls, ensuring transparency and accountability, implementing anti-corruption measures, and passing a capital control law.

Legislation should prevent state financing through the Central Bank (e.g., repealing Article 91 of the Code of Money and Credit), strengthen the BDL's regulatory authority, and enforce strict internal oversight within banks. Financial operations must be monitored rigorously for compliance with local and international regulations, and those responsible for mismanagement or corruption must be held accountable.

The capital control law plays a key role in restoring trust. It should be applied gradually and lifted in tandem with economic stabilization.

4. Stimulating the Real Economy

This involves comprehensive structural reforms, support for productive sectors, and the creation of social safety nets.

Reforms should focus on restructuring entire sectors, liberalizing the economy, curbing monopolies, attracting investment, and creating jobs. Public or public-private investment is needed to rehabilitate and upgrade infrastructure, reduce bureaucratic hurdles, and improve the business environment.

A clear strategy for boosting the industrial and agricultural sectors is also essential to reduce imports and stimulate economic growth.

Simultaneously, robust social safety nets must be introduced to ensure dignified living conditions for marginalized populations, with full transparency and accountability.

In Conclusion

All proposed solutions from officials and stakeholders can be integrated, in one form or another, into this methodology. The government must choose the measures that best serve the interests of citizens and the economy, ensuring that the legislative package is coherent and comprehensive. While no magic solution exists to end a crisis of this magnitude—one that affects every economic and financial entity—this methodology’s strength lies in its strategic approach, highlighting both problems and solutions while aligning with the country’s economic and social realities.

Please post your comments on:

[email protected]

Politics

Politics