Egypt finds itself under unprecedented multifaceted pressures, including the threat of seeing the Nile water volume reduced due to the Grand Ethiopian Renaissance Dam, and Israel and the U.S. demand that it accepts the relocation of the Gaza population.

Egypt's survival is inextricably tied to the Nile River, which provides 97% of its freshwater for agriculture, industry, and domestic use. The Grand Ethiopian Renaissance Dam [GERD], nearing completion in 2025, threatens to reduce the Nile's flow by 25% during multi-year filling periods, risking the collapse of Egypt's agricultural sector. Over 84% of Egypt's farmland lies in the Nile Delta and Valley, regions already strained by salinization and urban encroachment. A 20% water shortage could wipe out 1.1 million jobs in agriculture, which employs 23% of Egypt’s workforce.

Diplomatic efforts, including U.S.-brokered talks in 2020–2023, collapsed when Ethiopia rejected binding agreements, citing sovereignty concerns. Egypt and Sudan argue that colonial-era treaties signed in1929 and 1959, guarantee their historic rights to Nile waters, but Ethiopia dismisses these as obsolete. Egyptian President Abdelfattah el-Sisi's government has invested $2.5 billion in desalination projects since 2022, targeting 6.4 million cubic meters/day by 2030. However, energy-intensive desalination could increase Egypt's oil imports by 15%, worsening its trade deficit.

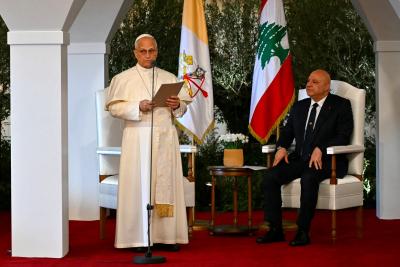

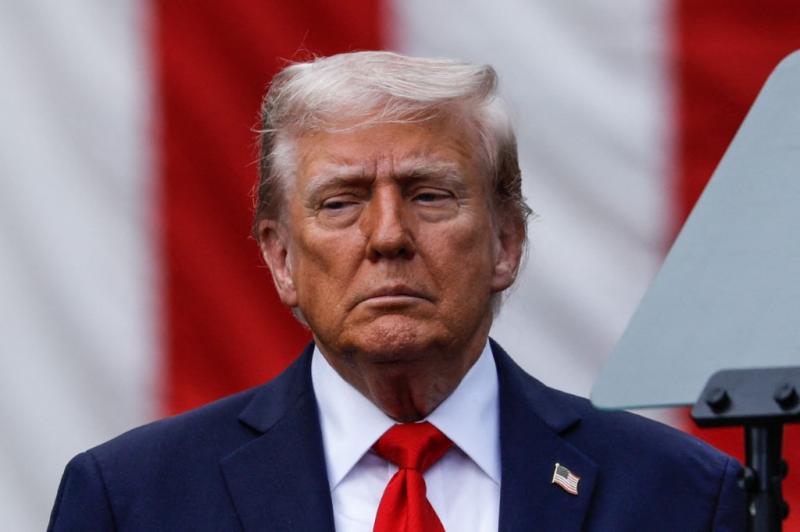

Military options, though publicly dismissed, remain on the table. Satellite imagery reveals Egyptian air base upgrades near the Sudan border, potentially enabling strikes on GERD infrastructure. Yet, Ethiopia's regional alliances, notably with Eritrea and Somalia, and Russia's diplomatic backing complicate escalation scenarios. Egypt now awaits a Trump administration aggressive mediation, following Biden's team prioritizing African Union-led solutions.

Refugees: Economic Boomerang, Social Strain

Egypt hosts 9.1 million refugees and migrants, the largest population in Africa. Sudan's civil war initially sent 1.5 million refugees into Egypt, doubling rents in Aswan and Luxor. However, the Sudanese Armed Forces' [SAF] recapture of Khartoum in early 2025 triggered a reverse exodus, leaving 43,000 vacant apartments in Cairo's outskirts and threatening a $12 billion real estate sector with bankruptcy. This volatility exposes Egypt's reliance on crisis-driven economic boosts, a risky strategy amid regional instability.

The Gaza conflict presents a political minefield. Egypt's construction of a 20 km² buffer zone in Sinai, ostensibly for counterterrorism, has sparked rumors of planned Palestinian resettlement. Public opposition is fierce: 78% of Egyptians in a 2025 Arab Barometer survey opposed accepting Gaza refugees, fearing permanent displacement mirroring 1948's Nakba.

Meanwhile, Libya's fragmented governance disrupts remittances from 2.3 million Egyptian workers, who sent home $13.6 billion annually pre-2020. With Tripoli's ports under militia control, these critical inflows have halved, deepening poverty in Upper Egypt.

Economic Strains: Suez Canal Crisis, Debt Spiral

The Suez Canal, which contributed 2.3% of Egypt's GDP in 2023, faces unprecedented challenges. Houthi attacks on Red Sea shipping since late 2023 diverted 45% of container traffic to the Cape of Good Hope route, slashing canal revenues from $9.4 billion (2022) to $3.8 billion (2024). This downturn jeopardizes the $8 billion New Suez Canal expansion, designed to double daily transits but now operating at 62% capacity.

Concurrently, tourism, contributing $16 billion to the GDP, remains hostage to regional conflicts. The 2023 Israel-Hamas war triggered 55% cancellations in Red Sea resort bookings, while attacks on Coptic churches in Minya deterred cultural tourism. These shocks exacerbate a foreign currency crisis: Egypt's reserves ($35 billion) cover just 4.6 months of imports, far below the IMF's recommended 7-month threshold.

The government's reliance on Gulf bailouts ($41 billion since 2022) and IMF loans comes at a cost. The 2024 IMF deal mandates cutting fuel subsidies by $5.8 billion annually, sparking protests in Alexandria and Port Said. With external debt at 92% of GDP, economists warn of a "debt trap" as 40% of revenue now services interest payments.

Demographic Time Bomb: Scarcity Meets Population Surge

Egypt's population, growing by 1.7 million annually, could reach 160 million by 2050, a 60% increase from 2025. This surge strains resources: Water availability per capita has plummeted from 2,526 m³/year (1959) to 560 m³ today, far below the 1,000 m³ scarcity threshold. Climate change intensifies the crisis: A 30 cm Mediterranean rise by 2030 could inundate 30% of the Nile Delta, displacing five million people.

Youth unemployment (24.8% in 2024) fuels discontent. Each year, 800,000 new entrants join a job market where 62% of firms cite "skills mismatches" as hiring barriers. In Beni Suef and Sohag, where 33% live below the poverty line, dwindling Libyan remittances have spiked illegal migration to Europe. The government’s "Two Is Enough" campaign to curb births has barely dented fertility rates (3.1 children/woman), hindered by rural resistance and insufficient healthcare access.

Political Implications: Authoritarianism vs. Reform

President Sisi's regime has been facing its gravest challenges since 2013; it prioritizes regime stability over democratic reform. The 2024 election, marred by opposition arrests and media censorship, extended his term to 2030, but public tolerance is fraying. Bread price hikes in January 2025 sparked riots in Mansoura, met with internet shutdowns and mass detentions.

The military's economic dominance (controlling 40% of GDP) shapes crisis responses. Army-led projects, like the $58 billion new administrative capital, prioritize elite interests over public needs. Meanwhile, GERD negotiations are managed by intelligence agencies, sidelining diplomats and technocrats.

Pathways Forward: Reform or Collapse?

Egypt's survival requires urgent, multifaceted reforms:

1. Water Innovation: Accelerate drip irrigation adoption (currently used on 12% of farmland) and expand wastewater recycling beyond 8.8 billion m³/year.

2. Economic Diversification: Redirect Suez Canal Zone investments to high-value sectors like pharmaceuticals and AI, leveraging EU “nearshoring” funds.

3. Debt Restructuring: Negotiate longer IMF repayment terms and swap debt for climate resilience projects, as proposed by COP29.

4. Regional Diplomacy: Revive the 2015 Declaration of Principles on GERD with binding arbitration, possibly through the UN Security Council.

Without systemic changes, Egypt risks a Syrian-style destabilization: Water shortages, youth unemployment, and austerity could converge into mass unrest. The window for action is narrowing, as the coming five years will determine whether Egypt evolves into a resilient, diversified economy or becomes a cautionary tale of climate-driven collapse.

Please post your comments on:

[email protected]

Politics

Politics