Joint Public-private partnerships (PPPs) are long-term contractual agreements between governments and private companies aimed at leveraging private expertise and capital to develop infrastructure and improve public services. One of the most important features of PPPs is the competitiveness among private firms, which ensures efficiency, as well as risk-sharing between the public and private sectors. By relying on private sector resources, PPPs enable a more sustainable and structured development of public infrastructure and services. This model stimulates private investment, enhances service quality, shares operational risks, and eases the financial burden on the state.

There are various types of PPPs, classified according to roles, asset ownership, and revenue sources. These include: Build-Operate-Transfer (BOT), Build-Own-Operate (BOO), Build-Own-Operate-Transfer (BOOT), Build-Lease-Transfer (BLT), Rehabilitate-Operate-Transfer (ROT), Design-Build (DB), Design-Build-Finance (DBF), Design-Build-Finance-Operate (DBFO), Design-Build-Finance-Maintain (DBFM), Design-Construct-Manage-Finance (DCMF), User-Pays PPPs, Government-Pays PPPs, Management Contracts, Lease Contracts (Affermage), Service Contracts, Joint Ventures (JVs), and Asset Monetization. Choosing the optimal model depends on several factors, including project requirements, risk allocation, funding needs, project objectives, and the legal and regulatory environment. This approach ensures alignment with national priorities and promotes sustainable infrastructure development.

In Lebanon, Law No. 48/2017 formally established the framework for PPPs and assigned project oversight to the Higher Council for Privatization. Various projects were studied for PPP implementation, such as those in telecommunications, waste management, the expansion of Beirut International Airport, the Khaldeh-Nahr Ibrahim highway, and renewable energy initiatives. However, many attempts failed due to the lack of a clear legal framework, criticism that PPPs served elite interests, political instability, widespread corruption, and unclear risk-sharing mechanisms.

Today, despite the existence of a legal structure, economic and political crises continue to hinder the application of the law. As a result, Lebanon is missing critical opportunities to develop its infrastructure and public services. The compounded effects of the economic collapse and ongoing political turmoil prevent the government from fulfilling its duties, particularly the urgent need to rehabilitate and modernize vital infrastructure. In this context, PPPs present the most viable solution to meet the pressing needs of public sectors and services.

Among the most suitable and feasible contract types for Lebanon’s current situation are "Rehabilitate-Operate-Transfer (ROT)" agreements. These are particularly effective for infrastructure such as the Port of Beirut and the national electricity network, focusing on restoring functionality and improving efficiency. These contracts offer short-term commitments, which can reassure private investors amid current uncertainties.

To address public service challenges, management and lease contracts provide an accessible entry point for private sector involvement in essential services such as water and electricity. Through these agreements, the Lebanese state can benefit from private sector expertise to enhance operational efficiency without transferring asset ownership or assuming major financial risks, which remain with the private sector through user fee collection in income-generating sectors.

Meanwhile, Build-Operate-Transfer (BOT) contracts are best suited for projects with guaranteed foreign currency revenue, such as airport expansions or telecommunications. These contracts offer private investors a clear pathway to recoup investments and secure returns.

The success of any PPP initiative in Lebanon depends on several key factors: establishing an independent and transparent regulatory framework free from political interference; ensuring political stability and the rule of law to build investor confidence; combating corruption and improving governance; identifying clear, bankable projects with comprehensive feasibility studies and transparent mechanisms; and addressing the economic crisis, particularly the instability of the national currency, as this is essential for attracting long-term investment.

Assessing the financial benefits of PPPs remains a challenge in Lebanon due to current uncertainties and the lack of technical data. However, several indicators can help decision-makers evaluate their potential:

1- PPPs attract significant private investment in infrastructure, reducing the strain on public finances.

2- The involvement of the private sector improves the efficiency of design, construction, operation, and maintenance, lowering overall costs.

3- Risk is partially transferred to the private sector, protecting public funds.

4- User-pays PPP models generate revenue that can cover project costs.

5- Infrastructure projects stimulate economic activity and job creation, ultimately increasing tax revenues over time.

6- Relying on private financing avoids adding to public debt and helps reduce existing liabilities.

7- The private sector introduces innovative technologies and management methods not typically available in the public sector.

In theory, if implemented with transparency and sound governance, PPPs could offer Lebanon considerable financial benefits by mobilizing private capital, improving efficiency, transferring risk, generating revenue, and spurring economic growth.

Simulating Financial Gains

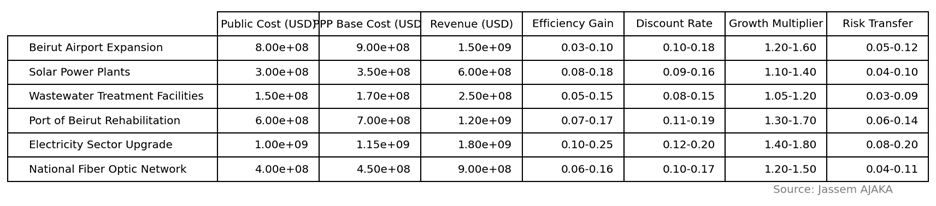

To simulate the financial impact of PPPs, we analyzed a sample of sectors suitable for private sector collaboration: the expansion of Beirut International Airport, solar power stations, wastewater treatment plants, the rehabilitation and expansion of the Port of Beirut, upgrades to the electricity network, and the development of a national fiber-optic network. We based our analysis on technical assumptions detailed in Table 1.

Table 1: Assumed Technical Parameters (see original source).

Table 1: Assumed Technical Parameters (see original source).

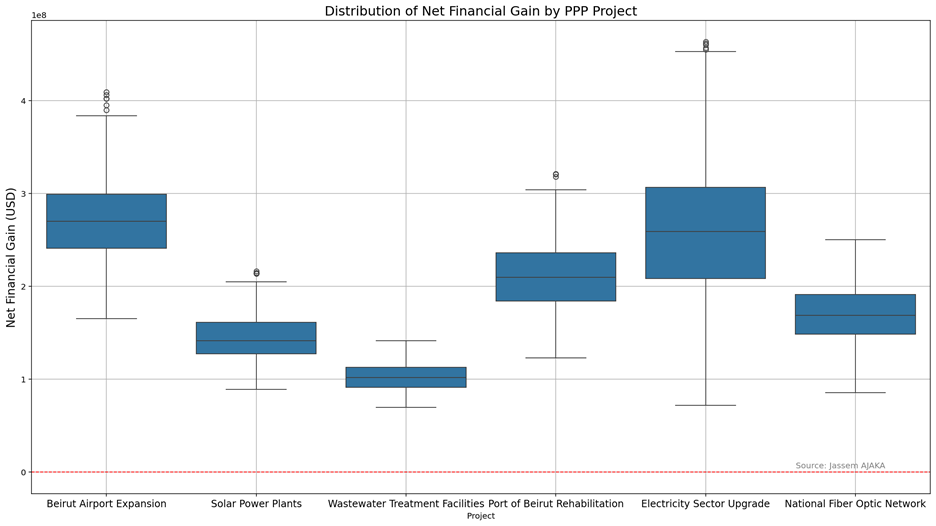

We calculated the net financial benefit as the total net present value (NPV) of profits over the full lifecycle of each project. The results showed that all analyzed projects are financially viable, with positive NPVs across the board. Notably, the Port of Beirut and the electricity sector stand out in terms of financial returns (see Chart 1).

Chart 1: Net Present Value (NPV) of Selected Projects (Source: Author’s Calculations)

Chart 1: Net Present Value (NPV) of Selected Projects (Source: Author’s Calculations)

Naturally, these figures are based on estimated assumptions and should be interpreted cautiously. However, they offer a valuable picture of the substantial financial and economic benefits of executing these projects through public-private partnerships. Ultimately, these benefits hinge on the implementation of structural reforms, macroeconomic stability, a transparent PPP framework, the attraction of credible private partners, and most importantly, an independent judiciary—the primary guarantor of successful partnerships.

Please post your comments on:

[email protected]

Politics

Politics