Since 2019, Lebanon—once hailed as a beacon of economic stability in the Middle East—has endured one of the most severe financial collapses in modern history. GDP has plummeted by over 40%, inflation has surged past 200%, and the Lebanese lira has lost more than 98% of its value. The country has entered a state of free fall. This article outlines a comprehensive and structured recovery strategy based on three key pillars: monetary and financial stabilization, governance and anti-corruption, and structural economic reform. Together, these pillars aim to restore economic stability, rebuild Lebanon’s financial credibility, and lay the foundation for sustainable long-term growth.

Pillar I: Monetary and Financial Stabilization

This pillar aims to restore confidence in Lebanon’s monetary system and financial sector, with a six-month implementation horizon from the plan’s launch. A key measure is the unification of the dual exchange rates that have distorted the economy and inflicted heavy losses on the national currency. The proposed unified exchange rate would be semi-floating, managed by the Central Bank in line with IMF recommendations to secure international support.

Lebanon’s banking sector, crippled by a severe liquidity crisis since 2019, is in urgent need of restructuring. This process requires comprehensive, transparent audits of the Central Bank, commercial banks, and the Ministries of Finance and Economy, particularly for the subsidy period. These audits would help allocate the financial gap proportionately among responsible parties—namely the state, the Central Bank, commercial banks, and violators of Law 44/2015.

The strategy begins with the enactment of a fair, short-term capital control law to replace arbitrary restrictions with legal and equitable mechanisms. This must go hand in hand with combatting the cash economy by mandating the use of digital payment systems in retail, thereby formalizing economic transactions and improving tax compliance.

Most critically, the government must issue an unambiguous statement guaranteeing bank deposits—provided compliance with Law 44/2015. Such a declaration, paired with a credible and transparent recovery roadmap, would be the cornerstone of rebuilding trust.

Restoring confidence also involves injecting $10 billion into the banking sector and granting depositors full access to their funds—within capital control limits—for domestic payments such as taxes, healthcare, education, and groceries.

Pillar II: Governance and Anti-Corruption

Spanning months 6 to 18 of the recovery timeline, this phase focuses on implementing essential governance reforms, with a strong emphasis on tackling systemic corruption—a key driver of Lebanon’s economic collapse. The priority is to restore institutional integrity and accountability, while aligning national practices with international standards to foster inclusive recovery.

No real economic revival can occur without addressing Lebanon’s entrenched culture of impunity and fiscal mismanagement. This calls for independent judicial investigations into public spending during the subsidy era and the disappearance of $27 billion from state accounts. These investigations must be shielded from political interference and backed by robust legal frameworks.

Tax reform is equally critical—through rigorous audits, stricter enforcement, and closing loopholes to reduce tax evasion and expand the formal tax base. Increased revenues must be redirected toward essential public services.

Compliance with international financial standards is also vital to resume external financial flows and attract donor support. This includes anti-money laundering measures, counter-terrorism financing, and amendments to banking secrecy laws to enable external audits and legal probes into the financial sector.

Pillar III: Structural Economic Reform

This final phase, extending from months 18 to 36, involves reshaping Lebanon’s economic model into a sustainable framework. Public sector restructuring—both institutional and fiscal—will reduce inefficiencies and the financial burden on the state.

Public-private partnerships (PPPs) will be essential, especially in vital sectors like energy, where private investment can spur modernization. Simultaneously, public debt restructuring will help secure long-term financial stability. These efforts must be complemented by expanding social safety nets to fully protect vulnerable populations.

The fight against corruption remains central to reducing the fiscal deficit. It must be paired with improved public expenditure management to ensure efficient use of state resources.

Tangible Results

If implemented correctly, this plan promises numerous economic benefits:

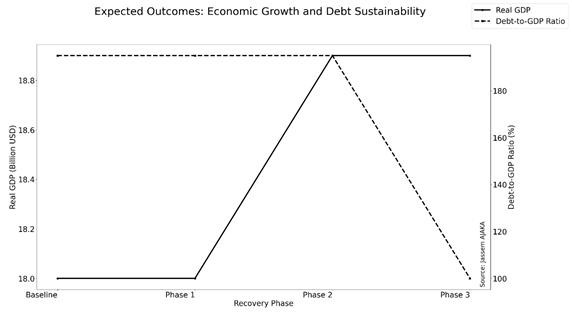

- GDP growth: Projected between 4.5% and 6%.

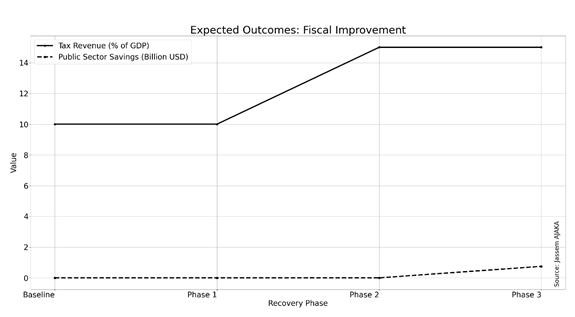

- Tax revenue increase: By formalizing the economy and curbing evasion, tax revenues could rise by 4–6% of GDP, or roughly 2–3% annually.

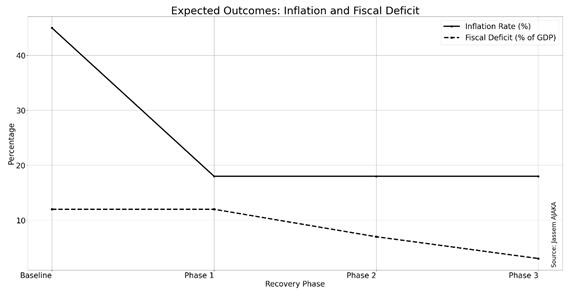

- Inflation control: A unified exchange rate and coordinated monetary policy could bring annual inflation down to 15–20%.

- Fiscal deficit reduction: Through public sector reform and revenue growth, the deficit could drop below 3% of GDP.

Supporting Data

The three charts accompanying this article (Figures 1, 2, and 3) are based on simulations conducted by the author using current data from the IMF, World Bank, Central Administration of Statistics, and the Central Bank of Lebanon. The results underscore a critical conclusion: a way out of Lebanon’s economic crisis is not only possible—it is inevitable with the right roadmap.

Figure 1: Inflation and fiscal deficit projections across the plan’s three phases.

Figure 1: Inflation and fiscal deficit projections across the plan’s three phases.

Figure 2: Economic growth and public debt forecasts across the plan’s three phases.

Figure 2: Economic growth and public debt forecasts across the plan’s three phases.

Figure 3: Budget revenue projections across the plan’s three phases.

Figure 3: Budget revenue projections across the plan’s three phases.

Please post your comments on:

[email protected]

Politics

Politics