As global trade tensions intensify—sparked by former U.S. President Donald Trump’s sweeping tariffs on 180 countries—an unexpected player may stand to benefit: Lebanon. The U.S. currently imposes only a 10% tariff on Lebanese exports, one of the lowest globally, giving Lebanon a notable competitive edge. But this advantage is not just a fleeting window; it represents a strategic opportunity for Lebanon to redefine its role in the American market.

Combined with the possibility of China devaluing its currency or slashing prices to offset losses, along with a drop in global oil prices, Lebanon finds itself at a unique crossroads—facing both economic hardship and the chance to pivot toward recovery. Amid this trade chaos, Lebanon could seize an opening to reduce its trade deficit and breathe life into its struggling economy.

A Shrinking Import Bill

China, the biggest loser in Trump’s tariff war, may respond by raising export prices to make up for its losses in the U.S. market. But this tactic has limits. Despite its massive population, China’s domestic market suffers from low purchasing power, making it an insufficient buffer against export losses. After decades of export-driven growth, Beijing faces limited short-term options.

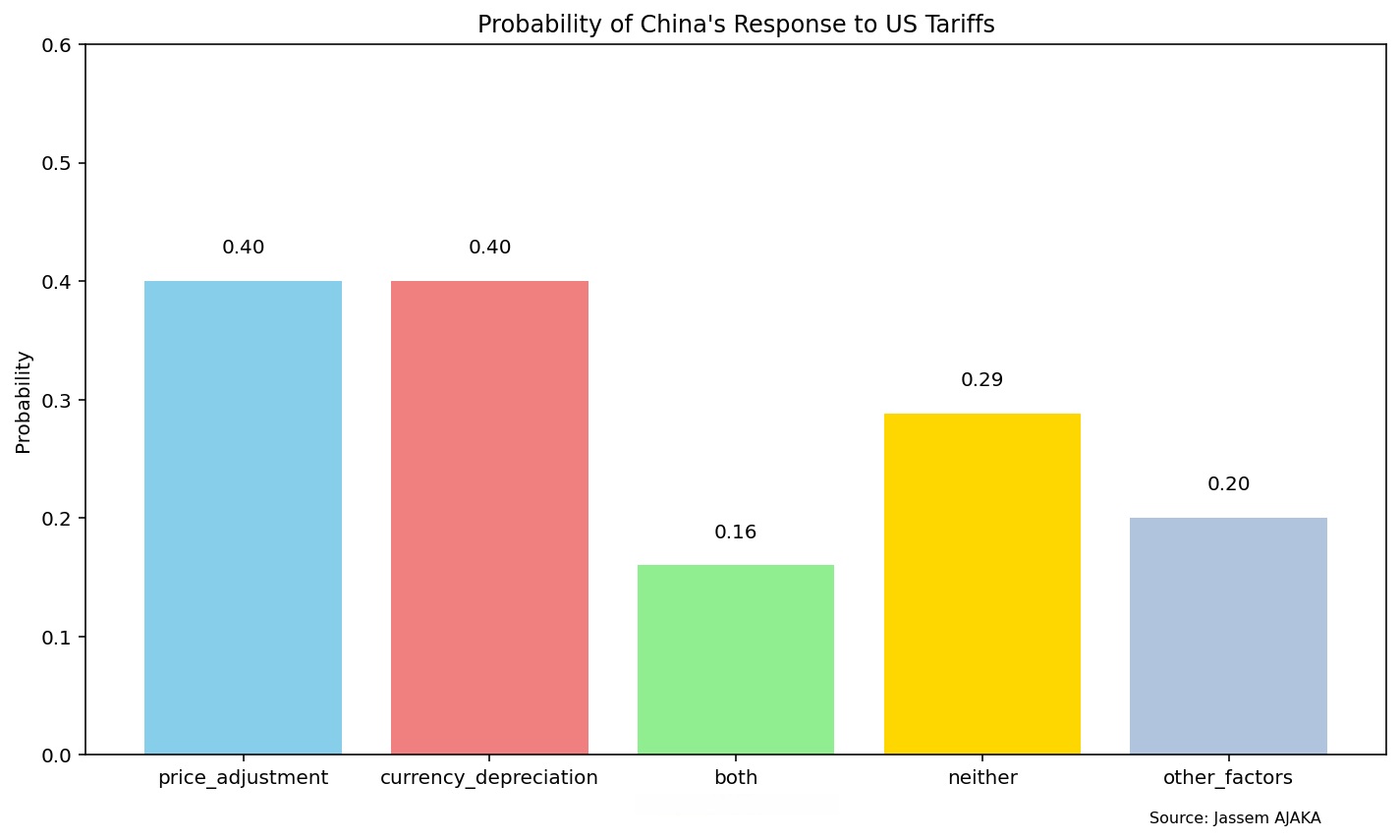

That’s why analysts believe China is more likely to adopt alternative measures—such as cutting prices or devaluing its currency—to stay competitive and minimize damage. Estimates suggest there’s a 40% chance China will lower export prices and an equally strong chance it will devalue the yuan, based on its long-standing economic strategies. If either of these scenarios unfolds, Lebanon stands to benefit through a reduced import bill, easing pressure on its trade deficit and slowing the outflow of foreign currency.

Illustration 1: Simulation estimating the probability of each scenario facing the Chinese authorities (Source: Our calculations).

Illustration 1: Simulation estimating the probability of each scenario facing the Chinese authorities (Source: Our calculations).

Illustration 2: Exchange rate of the U.S. dollar against the Chinese yuan (Source: investing.com)

Illustration 2: Exchange rate of the U.S. dollar against the Chinese yuan (Source: investing.com)

Moreover, falling oil prices—triggered by weakening demand from economic powerhouses like China and India—could significantly lower Lebanon’s energy bill and shipping costs. While precise savings are hard to quantify given current variables, this shift could substantially ease Lebanon’s trade imbalance and budget strain, ultimately helping curb inflation and improve consumer purchasing power.

Illustration 3: Price of a barrel of U.S. crude oil (Source: investing.com)

Illustration 3: Price of a barrel of U.S. crude oil (Source: investing.com)

Lebanese Exports: A Rare Advantage in U.S. Market

Lebanon's relatively low tariffs in the U.S. present an exceptional chance to expand its export footprint. With a 10% tariff rate—among the lowest worldwide—and the potential to compete on quality, Lebanese businesses are well-positioned to enter the American market. But time is of the essence. If Lebanese companies hesitate, this opportunity may quickly pass.

The Ministry of Economy and Trade has a critical role to play here. It must assess U.S. market demand and identify which Lebanese products could gain traction, implementing a three-phase export strategy:

- Short term: Focus on ready-to-export sectors such as wine, agriculture, and traditional Lebanese goods that can quickly penetrate the U.S. market.

- Medium-term: Identify products needing minor upgrades to meet American standards, offering companies guidance to close those gaps.

- Long-term: Encourage private investment in promising new product lines with future export potential.

In parallel, the ministry must act as a bridge between Lebanese exporters and U.S. importers, leveraging the reach of Lebanon’s foreign ministry and U.S.-Lebanon business councils—resources often out of reach for the private sector.

What It Takes to Succeed

Of course, seizing these opportunities hinges on Lebanon’s willingness to implement structural reforms in public administration, finance, and especially in its banking sector—which will be key for processing international payments. Political and security stability are also non-negotiable prerequisites, repeatedly emphasized by Lebanon’s international partners and allies.

Economic revival is more than a national ambition—it’s essential for social resilience. A growing economy boosts state revenues, enabling greater investment in healthcare, education, and public services. But for this to happen, Lebanon must also invest in infrastructure, which currently suffers from chronic underdevelopment.

The country urgently needs a comprehensive national infrastructure strategy, broken down into achievable phases, with funding sourced from both domestic and international investors—preferably in partnership with the private sector.

In a moment of global trade upheaval, Lebanon has a rare chance to rewrite its economic story. The question is whether it will act swiftly enough to turn possibility into progress.

Please post your comments on:

[email protected]

Politics

Politics