The Lebanese government has undertaken to address several challenges since taking office barely fifteen months ago. From the implementation of the ceasefire agreement and its strict provisions, which constitute a major obstacle to reforms, to the implementation of economic reforms, to the appointment of ministers and an electoral law that could completely paralyze its work, this government has managed to accomplish several tasks that previous governments were unable to achieve. These include, first and foremost, the nominations, which, although subject to criticism regarding their degree of compliance with established mechanisms, constitute a fundamental element of democracy, namely the transfer of power. Beyond the political aspect, and assuming no political complications, one wonders how the government can use fiscal policy and the Central Bank of Lebanon's monetary policy to move the Lebanese economy from its current situation to one where economic growth is the dominant force, supported by domestic and foreign investment. The emphasis on economic growth in this context stems from the principle that it is a fundamental element of exchange rate stability, allowing losses (of all kinds) to be absorbed and supporting state revenues through taxes on economic activity. Therefore, stimulating economic growth, as we will demonstrate later in this article, includes all the reforms demanded by the international community through the International Monetary Fund.

Fiscal Policy

The crisis that has gripped Lebanon since 2019 has revealed the extent of the state's financial imbalance and its loss of credibility, both in terms of its chronic international financial deficit and the non-payment of its debts. Fiscal policy, including public spending and tax collection, requires several necessary measures:

- Control the public spending and direct it toward growth sectors of the economy (health, education, infrastructure), which requires a restructuring of the public sector, both institutionally and functionally. Institutionally, economically inefficient public enterprises, numbering more than ninety (2019 Finance and Budget Committee report), must be eliminated. The management of institutions providing public services must be privatized through partnerships with the private sector, which will improve the efficiency of these institutions and the services they provide, and reduce costs for the public treasury.

- Unify the Lebanese pound exchange rate due to the distortions created by the existence of multiple exchange rates (there are currently two exchange rates for the Lebanese pound), thus eliminating any possibility of arbitrage against the national currency, as has occurred with checks and bank deposits. This will also lead to improved tax revenues.

- Rethink the tax system, which is socially unfair for citizens and financially unfair for the state. With this in mind, efforts must be made to broaden the tax base, make it progressive, and improve and extend tax collection to assets not used in the economy.

- Adopt laws (decrees) aimed at improving the business environment through anti-corruption, regulation, reducing bureaucracy, and partnerships with the private sector. All of this inevitably contributes to encouraging investment and, therefore, economic growth.

Monetary Policy

Regarding the monetary policy, which is the exclusive responsibility of the Central Bank and must be integrated with the fiscal policy, several measures must be taken:

- Restoring the confidence in the Lebanese pound is at the core of these measures. This requires a transition to a flexible exchange rate, followed by a transitional period during which the exchange rate is guided by clear and transparent interventions of the Central Bank on the foreign exchange market, while supporting public finance reforms, given their impact on exchange rate stability, particularly during the transitional period.

- Adopting the objective of controlling the inflation rather than the price stability in the monetary policy, which requires in-depth macroeconomic simulations to accurately predict the macroeconomic variables that affects the inflation. It is worth noting that despite the dollarization of the Lebanese economy, inflation continues to register high levels, which confirms our assertions. We believe that the banking sector restructuring law should be developed primarily by the Banque du Liban, given the precision of the figures at its disposal, the need for advanced technical expertise (available within the Central Bank), and the fact that the role of the Central Bank, as stipulated in the Money and Credit Law (Article 70, paragraph 3), is to manage and preserve this sector. The Central Bank must propose a plan to restore the sector's solvency and liquidate ailing banks, prioritizing the legal banks' capital deposits.

We also believe that the capital control law should emanate from the Central Bank, as it is in a position to propose a formula for managing capital flows and addressing existing deficits, particularly during the transition period. There is no doubt that the Central Bank faces a major challenge: maintaining the current level of foreign exchange reserves, which compromises the objective of returning a portion of the required reserve deposits (depositors' funds to the Central Bank).

- Adopt a market communication policy similar to that of Western central banks, which stipulates "say what will be done," "do what has been said," and "consolidate what has been said and done." This is the very essence of trust and credibility.

Policy Coordination and Integration

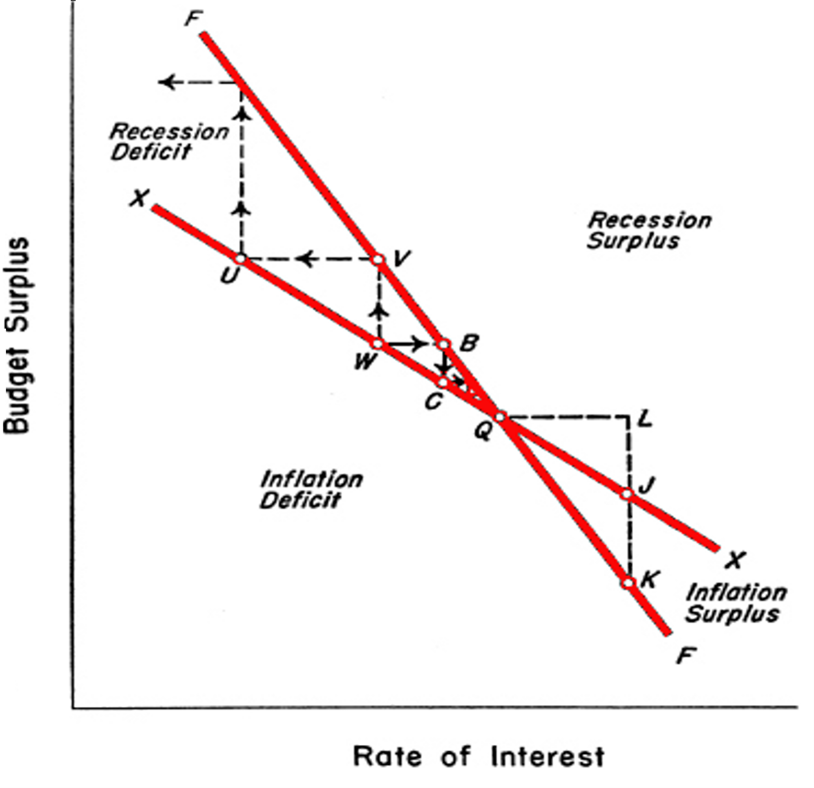

It is well known, and stipulated in all free economic systems, that central banks are independent. However, this does not mean that monetary policy operates within a separate framework from fiscal policy. Rather, there is a mandatory integration between the two policies in order to serve the interests of the economy, not those of the powers that be. Therefore, the successful implementation of plans and measures depends on cooperation and coordination between the two policies, ensuring the sustainability of the economic, financial, and monetary system (see Figure 1).

Table 1: Exchange rate determination depends on coordination between fiscal and monetary policies (Source: Wong et al., 2002).

Table 1: Exchange rate determination depends on coordination between fiscal and monetary policies (Source: Wong et al., 2002).

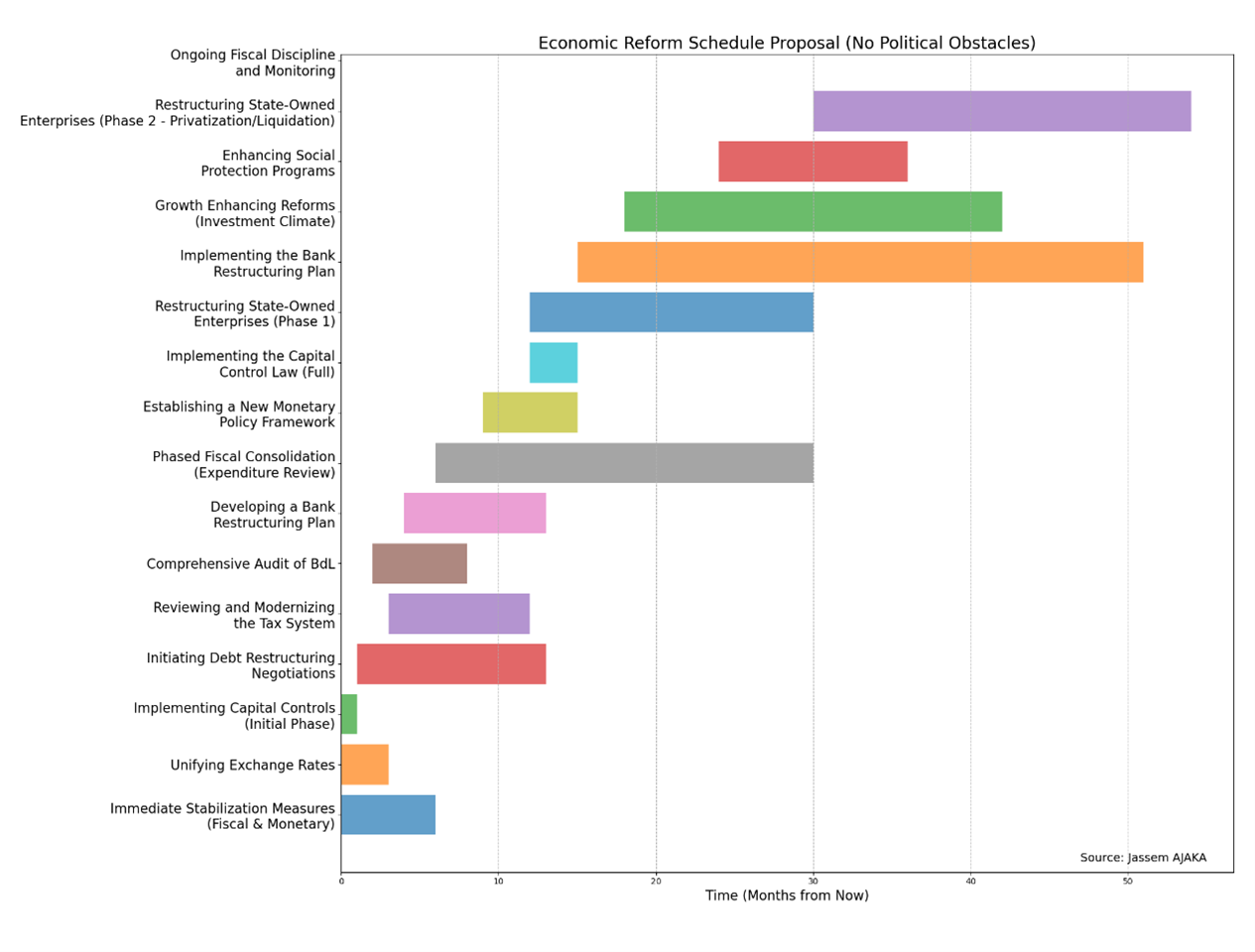

Therefore, a timetable, such as the one proposed in Table 2 and based on the measures described in this article, can be established. It is clear that in less than five years, financial stability can be achieved, confidence in the economic and financial space restored, and growth rates comparable to those of the first decade of this century can be attained. However, achieving these objectives requires positive political will and the will to implement it, which paves the way for international assistance. It also requires that no political obstacles, whatsoever, should compromise this will.

Table 2: Proposed timetable for the roadmap for reforms in Lebanon (Source: Author)

Table 2: Proposed timetable for the roadmap for reforms in Lebanon (Source: Author)

Please post your comments on:

[email protected]

Politics

Politics