Morgan Ortagus, Deputy U.S. Envoy to the Middle East, recently revealed that relying on the International Monetary Fund (IMF) is just one of several options available for helping Lebanon out of its deepening crisis. In a recent televised interview, Ortagus announced she has “a big plan” that, if successful, could spare Lebanon from needing an IMF loan by attracting foreign investment—conditional upon major reforms to combat corruption, rebuild trust in the banking sector, and confront Hezbollah’s influence.

So far, no official documents detailing Ortagus’s so-called "Big Plan" have been made public, nor have the promised investments been clarified. However, several media leaks and expert analyses have shed light on the possible pillars of this plan (see Chart 1):

1- Attracting Foreign Investment: Creating an economically, legislatively, and administratively friendly environment for international investors.

2- Comprehensive Reforms: Implementing economic, financial, banking, and judicial reforms aimed at restoring confidence in Lebanon’s economic system and eliminating the informal economy.

3- Fighting Corruption: Tackling rampant corruption in both the public and private sectors—an obstacle that investors consistently cite as the primary barrier to restoring faith in Lebanon.

Illustration 1: Key Components of Ortagus’ Plan (Source: the author)

Illustration 1: Key Components of Ortagus’ Plan (Source: the author)

4- Ensuring Security and Stability: Establishing a stable environment for doing business, particularly by limiting arms to state control, securing the Syrian border, and extending the UNIFIL mandate in the south, with possible deployment along the eastern border as well.

5- A Political Dimension: Perhaps the most controversial point—pursuing peace with Israel through a two-phase process: first, land border demarcation; second, a formal peace treaty.

If accurate, this outline suggests the U.S. administration sees Lebanon playing a specific political and economic role in the region, especially in light of recent military developments since the onset of the Al-Aqsa Flood operation.

It is also worth noting that the IMF’s stringent demands, such as deposit haircuts, and the political class’s evasive behavior ahead of upcoming parliamentary elections make it unlikely that Lebanon will sign an IMF deal in the short or even medium term.

Can “The Big Plan” Succeed?

The success of Ortagus’s plan will depend on several tightly interwoven factors:

1- Political Stability (Domestic Factor): A cornerstone for economic recovery and reform implementation. This stability can only be achieved through a broad political consensus on a unified national vision.

2- Security Stability (Domestic Factor): A pillar of trust for both investors and consumers. Security underpins confidence in any economic recovery.

3- Political Will and Capacity (Domestic Factor): The willingness and ability of Lebanon’s political class to implement long-overdue reforms in the judiciary, finance, banking, and monetary policy. Without them, no investor-friendly climate can be established.

4- Anti-Corruption Capacity (Domestic Factor): Combatting corruption is key to restoring faith in the economy and its institutions. However, due to Lebanon’s sectarian structure, anti-corruption efforts may prove politically and socially complex.

5- Monopoly of Arms by the State (Domestic Factor): A critical requirement for the U.S. and its allies. Without full state control over arms, no international investments are likely to materialize.

6- Public Support (Domestic Factor): This remains uncertain, as the plan includes politically sensitive components that may not have unanimous backing across Lebanon’s diverse sectarian communities.

7- Normalization with Israel (Regional Factor): A two-stage process—border demarcation followed by a peace treaty—is a key U.S. objective and part of the broader strategic reshaping of the region.

8- Stability in Neighboring Countries, Especially Syria (Regional Factor): Lebanon’s economy is closely intertwined with Syria’s, particularly in trade and tourism, making regional calm a prerequisite for recovery.

9- Positive Relations with Arab States (Regional Factor): Lebanon's ties with neighboring Arab nations remain critical due to their influence on the country’s economic and political dynamics.

10- U.S. Support (International Factor): American backing is essential. U.S. approval could unlock significant international aid and investment for Lebanon.

11- Foreign Investor Interest (International Factor): The appetite of global investors, likely influenced by U.S. endorsement, will be a decisive element in the plan’s feasibility.

12- Involvement of International Financial Institutions (International Factor): The willingness of institutions like the World Bank, IMF alternatives, and regional funds to contribute will also hinge on the American green light.

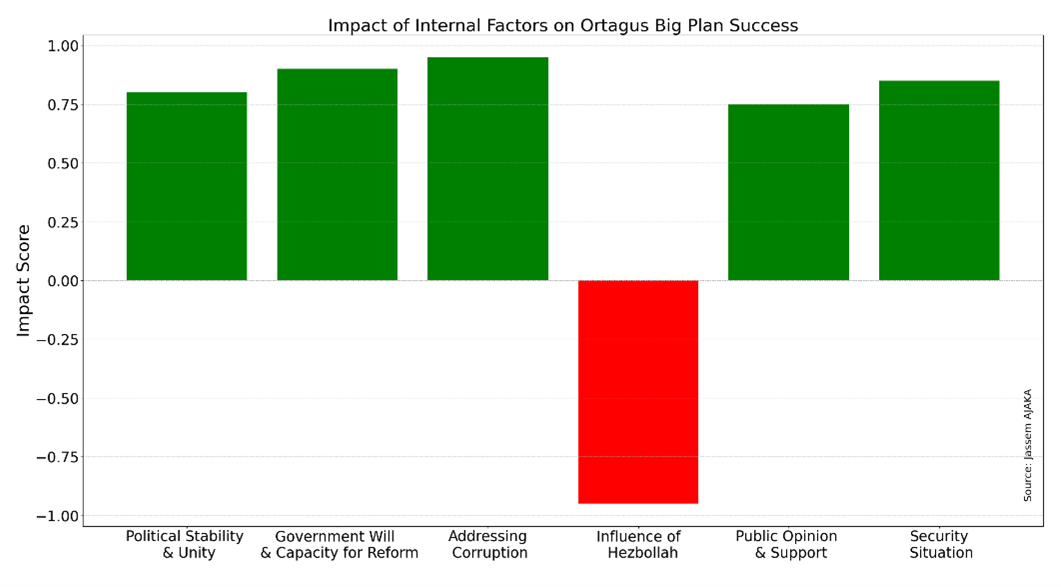

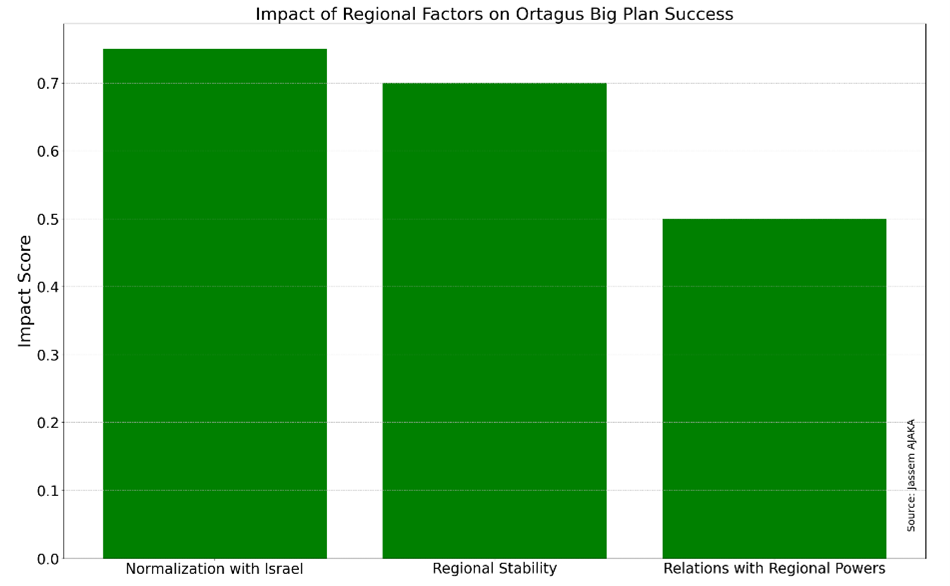

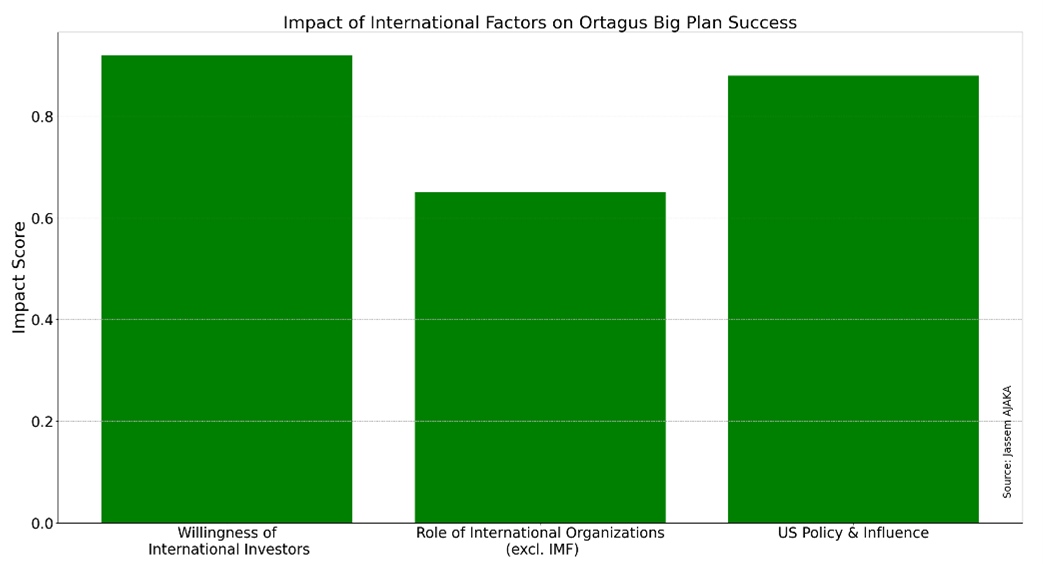

Charts 2, 3, and 4 reportedly show that the most critical variables affecting the success of the Ortagus plan are corruption and the state’s monopoly on arms, followed by normalization with Israel and regional stability.

Illustration 2: Impact of Internal Factors on the Success of Ortagus’ Plan (Source: the author)

Illustration 2: Impact of Internal Factors on the Success of Ortagus’ Plan (Source: the author)

Illustration 3: The impact of regional factors on the success of the Ortagus Plan (Source: the author)

Illustration 3: The impact of regional factors on the success of the Ortagus Plan (Source: the author)

Illustration 4: The impact of international factors on the success of the Ortagus Plan (Source: the author)

Illustration 4: The impact of international factors on the success of the Ortagus Plan (Source: the author)

Final Thoughts

Despite the strategic outline that’s beginning to emerge, many essential details of Ortagus’s “Big Plan” remain unknown, such as the specific nature of the investments, the sectors they’ll target, estimated investment amounts, and guarantees of delivery.

Still, one fact is clear: U.S. influence is rapidly expanding throughout the Middle East. If Washington officially adopts this plan, it will be hard for Lebanon to reject it, risking diplomatic isolation or even conflict.

Please post your comments on:

[email protected]

Politics

Politics